Adam Back

@adam3usDMAn exclusive PRIVATE retreat for devoted Traders. Ready to refine your trading skills? Let’s collaborate as we navigate the financial landscape. @adam3us

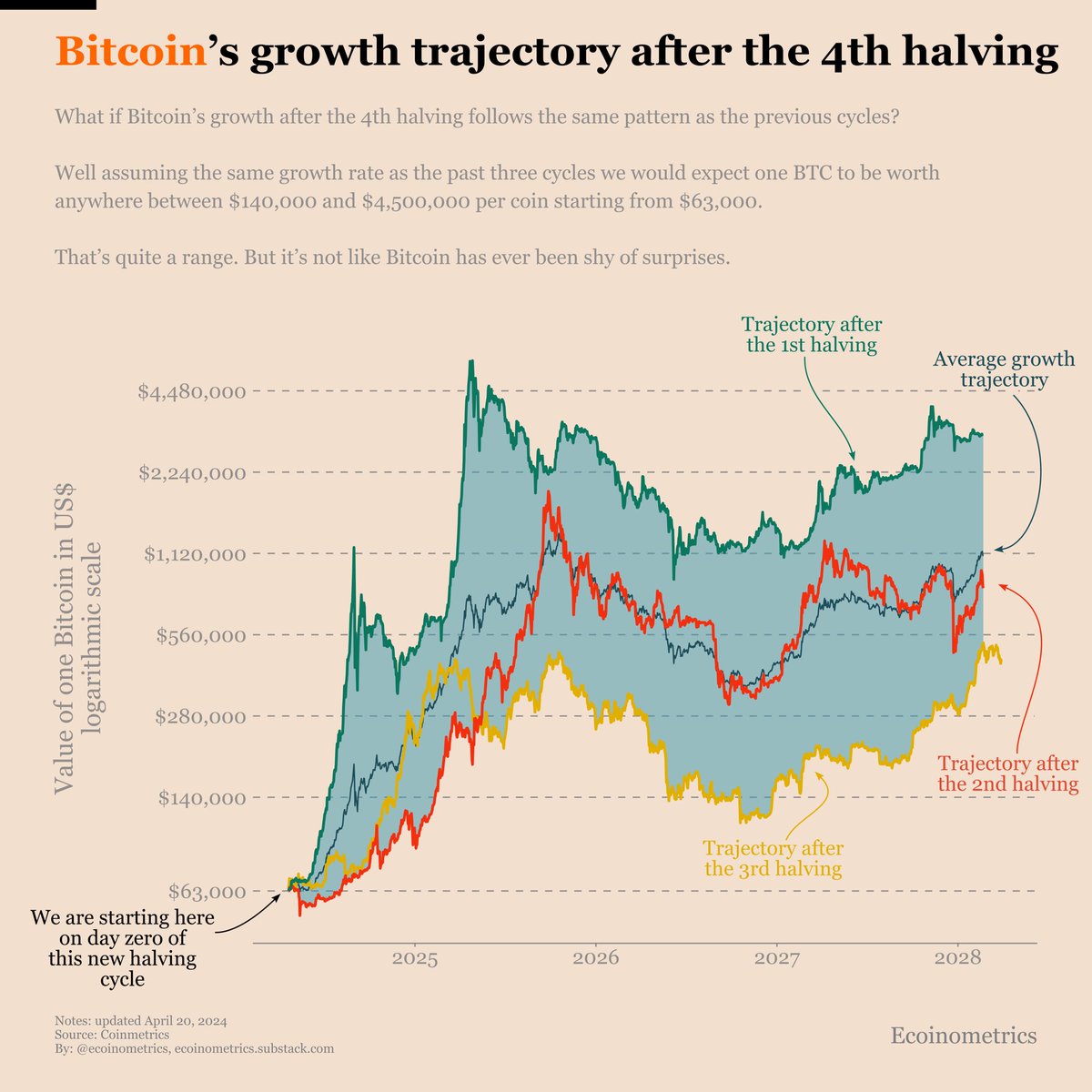

as this earlier cycle shows this bull-run volatility is normal, if anything this pre-halving run-up has been lower volatility than prior cycles bull-runs. someone have one of these handy for the later 2 cycles also (this and previous).

zoom out, #bitcoin at prices seen 4 weeks ago and 6 weeks ago. plus half a dozen > -30% dips are typical for a bull run. we're at -19% from ATH a few days before halving, with a never before seen second ATH pre-halving and ETF tail wind gathering.

for the big blockoors, just syncing a bitcoin full node from nov 2023 to-date today, took a few hours; and then had to rescan to add a private key, took 4.5 hours. and this is not a raspberry pi ... a reasonable laptop 4 core/8 hyperthreads i7, reasonable SSD, 32 GB ram.

mempool.space/tx/137e32892e6… we got a new ATH pre-halving, against everyone's expectations, but not $100k per my bet with @Vikingobitcoin9 made 5th aug 2023 price then around $29k. dug up my old 1Adam3usQMbQWScA5AXnnDsRMeZeCh6ovu vanity address for the 1million sat bet payout.

And I would view the new ATH pre halving as evidence of that, Bitcoin getting closer to where it would've been (over $100k IMO) in 2021 without that maelstrom of headwinds and calamity. So I think we should base this cycle on a corrected view of the last cycle, plus prior cycles.

And I agree with @ecoinometrics that cycles are not damping, the last cycle was muted by a few annus horriblus years of covid, supply chain, lockdown, QE money printing, bankruptcies and huge rugpulls FTX, Genesis, blockfi, Celsius, defi rugs etc. twitter.com/ecoinometrics/…

Some people think Bitcoin is due for more diminishing returns over the next four years. I think that’s not a hard rule. Megacap tech stocks are not suffering from diminishing returns. And Bitcoin is currently playing in the same category in terms of market size. For sure I…

The geometric mean of those new cycle ranges (if we track prior cycles) is about $800k, which is probably enough to flip gold as this will also pull down gold ETFs as investors are asked what they want to sell to do their #bitcoin ETF investment. twitter.com/ecoinometrics/…

Price range for Bitcoin in the 4th halving cycle: upper bound ~ $4,500,000 lower bound ~ $140,000 That is *if* Bitcoin ends up following a growth trajectory in the range of the previous cycles.

Noderunner, guardian of the timechain, self-sovereign order of the plebs! twitter.com/fartface2000/s…

I like the phrase “Guardian of The Timechain” to describe a self sovereign node runner.

Interesting analogy thread about Shitcoin on Bitcoin side-effects.

I like the phrase “Guardian of The Timechain” to describe a self sovereign node runner.

"It's time to stack sats and chew bubblegum, and I'm all out of gum." -Duke Nukem, Duke Nukem Forever

lols adam nukem. alright

I made millions of $’s trading in the NQ pit at CME, after divorce in 03 ,remarried in O5, huge changes in floor trading I was slow to react to, 2008 my Mom died in June, my sister died in Nov & my mother in law in March plus failure of my prop group I owned, real estate…

This is a must read for everyone - especially the young men here who follow me. spend time reading the replies - i did Horrible situation for Artem and his family There is some REAL talk in these replies

I haven’t taken the time to explain Capital Preservation Friday for a while. I don’t have to. This is a brilliant explanation. All traders should bookmark this. I will remind you all next week #CPF.

Capital Preservation Fridays. It's a term that I first saw @paxtrader777 use on X. I would like to now build a case for why it is essential for traders. Let's begin with an observation. If you were to carefully track your trading performance, it is very possible that your…

Remember-ES wants to trade to 5148-50. NQ Needs to test 17850-60.

Happy Capital Preservation Friday. I don’t think the indices do much today. ES & NQ made its move up & back down off the PCE # before the open. I would rather miss a move than to lose money. I will not be in front of the screens long today. Whatever the market does-it wil do it…

This was originally part of a thread from 2019. I was a top step arb clerk in the from month Eurodollar pit before I earned my shot at trading. I didn't want to fill orders, I wanted to trade. I know nobody when I walked on the llor. No rich dad. I had to earn it. My boss…

one last thing- It doesnt matter who much money you make, or have made or what stuff you have. The only true measure of success that matters is what you have when you stop trading for active income. When you retire, then and only then does it matter how much you made. 1 trade at…

A style of trading sued for decades on the fllor. He told me he would teach me a way to trade that would work in any market in the world at any place, on the floor or off. It worked than, it works now. He taught me to read capital flow. He introduced me to his friends

Clerking for one of the biggest brokers on the fl0or trained me to see, hear & compute a lot of info & act on it quickly. That stood me well as a trader. 1rst 6 months I couldnt make a nickel. Seat leases were $3200 a month. New wife, new baby. I bartendered at night

United States Trends

- 1. Jon Jones 237 B posts

- 2. Good Sunday 54,6 B posts

- 3. #UFC309 337 B posts

- 4. Jones 433 B posts

- 5. Chandler 92 B posts

- 6. #Jays_Neighborhood 2.767 posts

- 7. Aspinall 27,3 B posts

- 8. #sundayvibes 5.724 posts

- 9. Alec Baldwin 10 B posts

- 10. Mike Johnson 48,6 B posts

- 11. Oliveira 76,4 B posts

- 12. MY ATEEZ 70,2 B posts

- 13. #17Nov 1.427 posts

- 14. #Wordle1247 N/A

- 15. Kansas 24,4 B posts

- 16. THE LOYAL PIN FINAL EP 1,3 Mn posts

- 17. Jelly Roll 9.822 posts

- 18. Pereira 13,2 B posts

- 19. Dana 262 B posts

- 20. Mayu 18,8 B posts

Something went wrong.

Something went wrong.