EL

@_eltradesindices • I do not trade the market • I trade my edge

Similar User

@ScarfaceTrades_

@discobray

@trinity_tr8der

@Laffi_LY

@WheelSnipeSelly

@Chappy4Trading

@_cjtrades

@jamesb0009

@STAROHMERS

@JASON_3014

@Womantrader_

@Rtrades936

@__ThatTrader__

@Sanjay_mahato_

@Joji_ICT

Thanks for all the new follows! My best trading advice: 💎 Focus on the HTFs. They will simplify things a ton 💎 Get good at identifying the draw on liquidity 💎 Some things will come ONLY with experience. Be patient 💎 Losses are normal & the only armor for it is risk mngt

It’s wild how many people have been grinding for years and still can’t pass the first phase of a prop challenge, let alone both phases and actually get a payout. They look like they know what they’re doing, putting in work day and night for months, but it just never clicks.…

You can learn from someone but don't try to be exactly like that person you learnt from. Use the knowledge you got to refine your system and do what works best for you.

what happens on Mondays? traders are eager to get back to trading after the weekend, and rush into bad trades what happens on Fridays? traders are on a high after making money and want more, only to give it all back to the market take those days out and see what happens

after blowing 3 accounts in the span of 9 months self educating myself on trading, i also came to realization that Mon & Fri aren’t it at all!

Some days, sessions & times of day are inherently easier to trade than others If you’re a day trader, focus on filtering out Stop trying to add and do more Notice how I kept saying ‘avoid’ Growth & consistency in trading comes from subtraction; not addition

Struggling? Try this Avoid trading on Monday & Friday, Focus solely on Tuesday - Thursday Avoid trading the London session, Focus solely on New York Avoid trading before high impact news, Focus solely on trading post the release Find out for yourself

Struggling? Try this Avoid trading on Monday & Friday, Focus solely on Tuesday - Thursday Avoid trading the London session, Focus solely on New York Avoid trading before high impact news, Focus solely on trading post the release Find out for yourself

2022 Twitter was so much better. Everyone learning and helping each other. 2024 Twitter is a bunch of people arguing who was the first to name a candlestick My suggestion, ignore those that provide a distraction to your goals.

if you know little about many concepts you will believe everything is a trade, but unable to determine the quality ones if you know a lot about few concepts you will know almost everything is noise, and only find the quality trades don't complicate your approach, simplify it…

everything can line up right until it’s time to push the button so you have to constantly remain open to the idea of being sidelined when trading how? by having clear invalidation criteria for when you’ll disengage and walk away this is how you avoid low quality trades

if you want a mentor that truly cares, 10 out of 10 @_amtrades is THE one this is NOT a sponsored post he had NO idea this post was coming up I just wish someone had pointed me in his direction much earlier in my journey link in his bio has all the details thank me later

every trade is a process, and there are three parts to it the mindset before the execution during the journaling after when each of these are done correctly, every trade becomes a step in the right direction what does this look like? the mindset before, this is where you ask…

simplicity is the key to the charts journaling is the key to improvement trade management is the key to profits discipline in rules is the key to consistency focus on each of those, and put them all into one process following that process is your key to trading

first step towards a successful trading week? plan your week, plan your day athletes plan their time, CEOs plan their time, Business owners plan their time if you can’t control how you spend your time, don’t expect to perform at the high levels that these folks operate at

one of the hardest things for a developing trader to do is “sit still” but you need to realize that the market acts more irrationally than it is favorable your edge is not in always putting on trades your edge is in learning to avoid the days that you’re likely to be offside

at some point, you really need to ask yourself, how bad do I want this to work? that desire will drive you out of your comfort zone and take you into the place of discomfort to confront the losses, the impatience, the mistakes and anything & everything that is holding you back

consistent trading is uncomfortable it is uncomfortable to be patient, it is easy to be active in the market it is uncomfortable to commit to a plan, it is easy to act on emotions it is uncomfortable to hold winning trades, it is easy to close prematurely it is uncomfortable…

consistent trading is uncomfortable it is uncomfortable to be patient, it is easy to be active in the market it is uncomfortable to commit to a plan, it is easy to act on emotions it is uncomfortable to hold winning trades, it is easy to close prematurely it is uncomfortable…

the weekly open is everything the weekly open is narrative the weekly open is daily bias the weekly open is weekly profiles the weekly open is premium & discount start here and everything else will fall in place

In terms of the weekly profile on NQ What are we looking for the rest of the week? Tip: look at the weekly open

there is a difference between learning & practice learning is the acquisition of knowledge practice is the use of acquired knowledge most of you have learnt enough what you need now is practice give the concepts time, don’t seek to add more, seek to master what you know

there comes a time when, it doesn’t matter what you’ve learnt, or how much you know, or which system you trade with all that matters, is how well you execute most of us know the right things to do some know the things they shouldn’t do but only few can execute based on this

simple weekly range logic monday - thursday is an expansion friday should be a return back into the range $NQ +170 $YM +170 can't stop saying thanks to man himself @_amtrades 🙏

could it really be that simple? or I'm just trolling? 😂

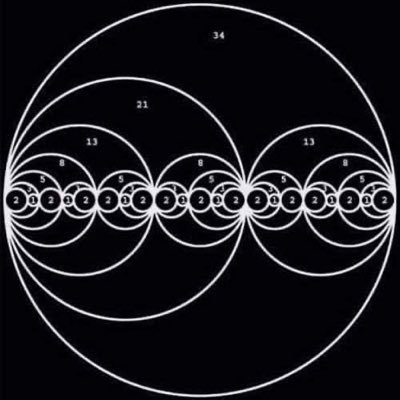

price is always moving in a cycle of small ranges to large ranges, consolidation to expansion large ranges attract traders, only to be caught in small ranges small ranges turn away traders, only to miss the expansion avoid consolidations, and be available for the expansions

United States Trends

- 1. #TheOfficialTSTheErasTourBook 8.367 posts

- 2. #TTPDTheAnthology 8.096 posts

- 3. #socialpanel24_com N/A

- 4. Black Friday 484 B posts

- 5. Great War 8.231 posts

- 6. #TaylorSwift 1.284 posts

- 7. #FridayVibes 4.842 posts

- 8. Datsun 12,3 B posts

- 9. YOKO AT BVLGARI 237 B posts

- 10. Algebra 10,8 B posts

- 11. Secured 36,5 B posts

- 12. Pledis 62,3 B posts

- 13. Barron 36,1 B posts

- 14. Aleppo 106 B posts

- 15. Winter Ahead 920 B posts

- 16. YMCA 17,3 B posts

- 17. Syria 158 B posts

- 18. Journalists 101 B posts

- 19. Swiftie 15,7 B posts

- 20. Hasbro 9.598 posts

Who to follow

-

Tony Trades

Tony Trades

@ScarfaceTrades_ -

bray

bray

@discobray -

Trinity Trader

Trinity Trader

@trinity_tr8der -

Laffi_LY

Laffi_LY

@Laffi_LY -

Adam

Adam

@WheelSnipeSelly -

Chappy

Chappy

@Chappy4Trading -

CJ

CJ

@_cjtrades -

James

James

@jamesb0009 -

STΔRΩHMΞR

STΔRΩHMΞR

@STAROHMERS -

Jason-ICT

Jason-ICT

@JASON_3014 -

Woman Trader

Woman Trader

@Womantrader_ -

Rtrades👽

Rtrades👽

@Rtrades936 -

I am

I am

@__ThatTrader__ -

turtlesoup🥷🏼

turtlesoup🥷🏼

@Sanjay_mahato_ -

JOJI

JOJI

@Joji_ICT

Something went wrong.

Something went wrong.