Seth Golden

@_Seth_CL_I specialize in VIX, Retail, Consumer Goods. Hedge fund consultant, chief market strategist Finom Group

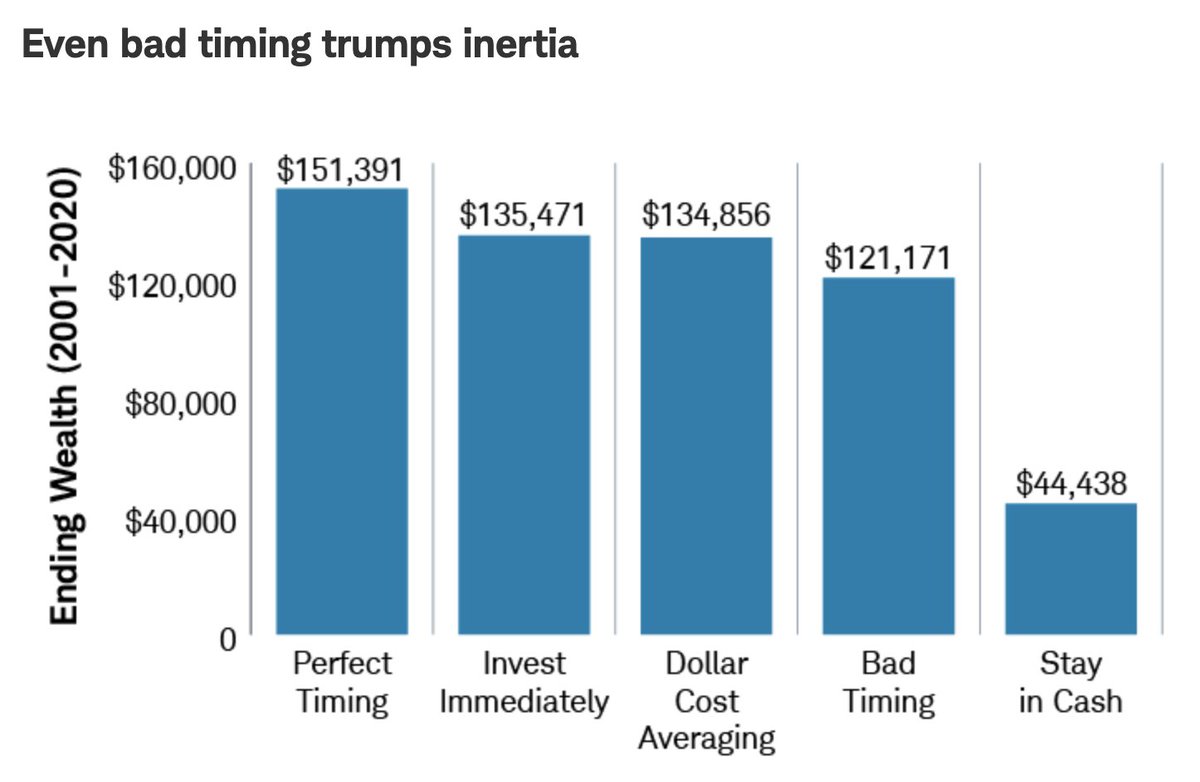

The lure of outperforming $SPX w/mkt timing often sign of ignorance or a "non-investor" altogether, putting on shows of analyzing mkt conditions, while maintaining a perma-cash pile. Even the best mkt timer has minimally better performance than Buy Any Time/DCA/Bad Timer $SPY

It is pretty. If you think otherwise, that is how wrong is done right 😁 $QQQ $NDX

This weekend's macro-market Research Report has been sent to subscribers! finomgroup.com/more-hurdles-f…

In my 23 years of investing I have never considered overweighting or equal weighting bonds... until now...considering...

There really aren't too many "Overbought" conditions presently, but if there is one flashing a signal for an upcoming pullback it is 10-DMA Net Advancers > 500. Sign of healthy uptrend, but good breadth tends to resolve w/pullback. $SPX $NYA $SPY $QQQ

Don't miss this weekend's macro-market Research Report at finomgroup.com Subscribe to unlock and receive access to all of our exclusive research and analytics.

Small Caps have 3 things going in their favor: 1⃣They have only been cheaper on absolute basis 2 other times since 1990s 2⃣If Fed is done small caps have outperformed in forward 6-mnth period 3⃣ 2ppt shy of all time relative low vs. $SPX $SPY $IWM $RTY $QQQ

BofA Michael Hartnett: "Never before have Treasuries fallen 3 consecutive years... we believe bonds will OUTPERFORM in 2024." $SPX $SPY $TLT $QQ $DIA

People feel the economy is for 💩! GOOD! Since 1970, investors buying at confidence peaks has only returned 3.5% over 12 months $SPX while buying at consumer sentiment troughs have returned 24% on average.

As Amazon shapes the economy, it also shapes the stock market. Since 2000 and relative to history, can see the dramatic, Amazon impact on Consumer Discretionary vs. S&P 500. $SPX $SPY $AMZN $QQQ $XLY

📢 2 things can be true in 2024 Yield-curve inversion precedes recession in 8/8 previous inversions. S&P 500 has delivered positive return in 10/10 prior Election years for First term president. Recessions w/positive returns (1945, 1949, 1970, 1980) $SPX $QQQ $SPY $DIA

UBS: "Investor pessimism has been overdone. While the Chief Investment Office continues to see near-term headwinds for equities, they also believe conditions are in place for positive total returns over the next six to 12 months" $SPX $SPY $QQQ $NDX $DIA

3 bear🐻markets in the last 4.5 years and 2 of those bear🐻markets without a recession. Not hard to understand how unique this macro-market cycle has been and why so many have so much uncertainty. One thing hasn’t changed, however; buy low and sell high. $SPX $SPY $QQQ $DIA

This proved to be a very strong signal that markets would likely turn near-term, and did. $SPX $SPY $QQQ $DIA $NYA

No McClellan Oscillators (A/D momentum) have been confirming price. Such Bullish divergence across major averages has not been seen in prior 5 years major declines/corrections in price. Remain optimistic, but only price pays! $SPX $SPY $QQQ $NYA $DIA $NDX

Golden Capital Portfolio is within 1% of intra-year high return while $SPX sits ~4% from its intra-year high. $SPY If one has the right long-term outlook, they can buy dip confidently and outperform benchmark. Our Research offers guided approach finomgroup.com

Constructing and installing banquette seating and storage with pet feeding cut out.

A reminder: Shutdowns are NOT historically associated w/negative $SPX returns. Avg return from all govt shutdowns since 1976 is +.3% Probably more relevant is what happens 1yr later, which is an avg return of +12.7% and positivity rate of ~87% $SPY $QQQ h/t @RyanDetrick

I hope to do our Veterans proud with $SPX chart. Thank you for your service! SPX breaks trend line w/a higher-high post corrective wave (2 week break is ideal). MACD crossover didnt propel above 0 in Oct, but has in Nov. There's > strength/power behind rally in Nov $SPY $QQQ

Hiccup late week found equilibrium to end another strong week in the markets. Two completed Finom Group trades today attach. My outlook still points to higher-highs. Don't forget to subscribe to finomgroup.com and receive our exclusive Research Report! Good weekend!

Earlier this year Nasdaq ended 8-week win streak (6/16/23). Nasdaq price 13,869 Since 1971 n = 20 6-months later higher 🆙 19, 📉 4 12-months later higher 🆙 20, 📉 3 $NDX $COMPQ $QQQ $TQQQ

United States Trends

- 1. Jets 35,9 B posts

- 2. Dolphins 26,7 B posts

- 3. Mahomes 18,7 B posts

- 4. Saints 32,6 B posts

- 5. Browns 29,9 B posts

- 6. Will Levis 4.292 posts

- 7. Lamar 36,6 B posts

- 8. Mac Jones 4.514 posts

- 9. Texans 17,3 B posts

- 10. Davante Adams 4.161 posts

- 11. Cooper Rush 3.918 posts

- 12. Panthers 25,3 B posts

- 13. #RaiseHail 9.126 posts

- 14. Rodgers 12,7 B posts

- 15. #ChiefsKingdom 6.206 posts

- 16. Jameis 5.610 posts

- 17. Tyreek 5.185 posts

- 18. Rattler 5.863 posts

- 19. Stingley 5.372 posts

- 20. Titans 26,1 B posts

Something went wrong.

Something went wrong.