Kelly Porter

@OmgStormyTrader. All thoughts, opinions, ideas and commentary are for education only.

Similar User

@ignis55

@icepiercer2020

@AnanthrSocial

@TedFCII

@tripsrus55

@CampigliTheo

@GGekho

@cw_hudson

@MrLooofa

@BrothertonKeith

@FerminlopFermin

@broukersito

@fugitive2019

@pocanempabe

@michaelmartinml

You can watch the full interview here: youtu.be/-5Weeox0Xus?si…

People who never achieve nothing in their lives will try to drain your energy when they see you trying to accomplish your dreams. Discipline. Block the noise. Stay focused. I'm going to make the life I always dreamed. It's a matter of time.

Quote of the Day: "If you're not trading well at 25% or 50% exposure, there is no reason to bump your exposure to 75%, 100% or on margin" ~ @markminervini There is a FORTUNE in this quote.

This gap ups when leaders are extended and market getting extended are perfect opportunities to trim some profits. Institutions use these gaps to trim instead of amateurs use this to chase, ending up getting chopped out. Market holding up quite well just need some breather.

Focus on stocks and how behave, stay in the loop of stocks-tactics-feedback. 1) Do we have setups? 2) Are this breaking out? 3) Are this following trough Everything else is noise, that´s my tip for handling weeks like this with the FOMC.

Focus on the process. Don't focus on money. Avoid the noise. Focus on the process, and money will follow.

I'm not going to lie. I have been very in sync with the market the whole year, but this V recovery has been challenging for me. Many stocks run up to the right side with very little sideways. I keep my exposure small as I haven't been able to gain much traction.

We’ve been working on a resource which charts all historical corrections in the market. Retweet and comment below if interested.

Every business is built around the process. Trading is a business. You need to make it process based business. More efficient your process more productive and profitable you will be as a trader. Focus on the process, steps of the process, why of process, how much of process, when…

It's time to share my latest @tradingview template, as it's been over 15 months since I last shared it. I've now settled on two separate templates: the default template and the post-earnings template. You may have also noticed how I've overlaid two separate indicators within a…

Over the years, I have received numerous DMs expressing interest in my @tradingview indicators and setup. I would like to take this opportunity to delve deeper into the subject and share 4 indicators that I believe can provide extreme value, especially for free users.…

JUST RELEASED! IBD Podacst with special guest 2-time U.S. Investing Champion Mark Minervini youtu.be/JjmoLSsR7yo?si… via @YouTube

LETTT THE TREASURE HUNT BEGIN. TIME TO FIND THE NEXT BEST EPs!

#earnings for the week of July 15, 2024 earningswhispers.com/calendar $NFLX $TSM $GS $UAL $BAC $UNH $ASML $BLK $IBKR $JNJ $AXP $PGR $NOK $ISRG $JBHT $MS $AA $CTAS $SCHW $DPZ $FBK $AEHR $SLB $ABT $ELV $DHI $PNC $BX $CFB $DFS $ALLY $ALV $BMI $INFY $PLD $STT $GNTY $HAL $KMI $CMA $CCI…

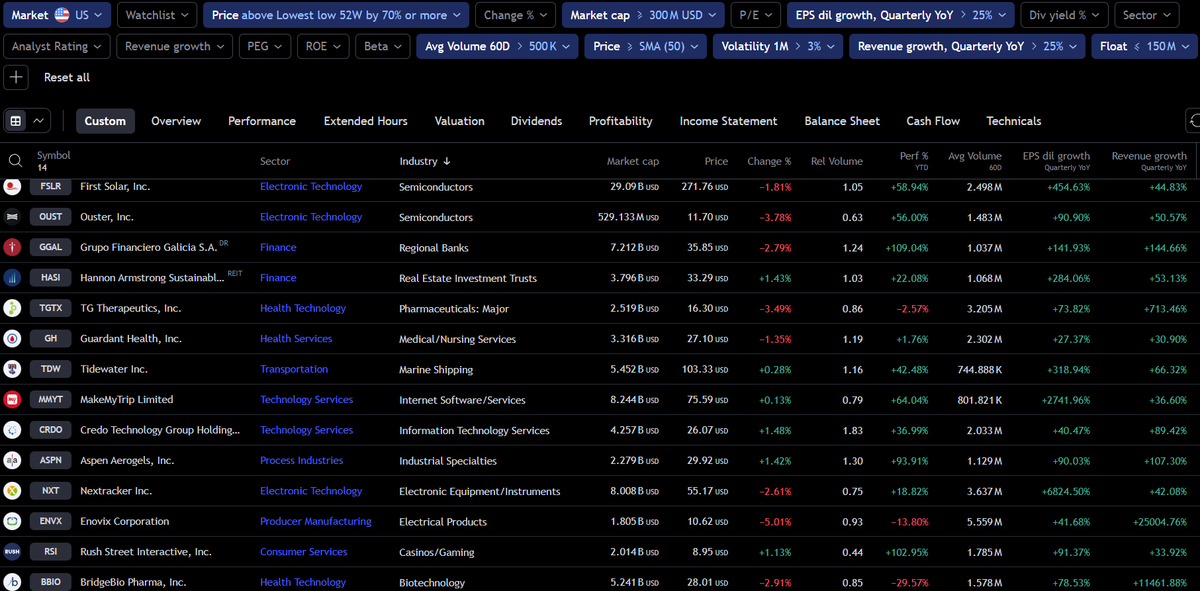

9 strongest growth stock screen this week, sorted by industry group for the upcoming week. I have included 1-week compression for setup and to sieve out stocks that already ran. $CORT $FROG $PGY $FOUR $MMYT $GRND $CRDO $ACMR $RSI

I share the results of this weekly scan on every end of the week session (Saturday/Sunday) because my primary focus each week starts with this names. Let me dissect down why we should keep an eye on these leaders for opportunities in both swing and positional trading: 1.…

The grind never stops. If you fail to plan, you plan to fail. With the strength shown by $IWM rhis past week, there's no better time to be ready.

Here is a list of names that I will choose two from, but I will need to research each in depth. Fundamentals is a really important part of the DD process. It allows you to sit tight and not get shaken out when the stock wiggles. The worst thing you can do is swing trade or…

A good drill to run is to ask yourself what stock can 5-10x from right here. With the recent strength in the $IWM and small and mid-caps, I think it's wise to begin screening for the best of the best of names that are not widely owned or known. Pick one or two names. This is…

@PradeepBonde off yesterdays what I call 'Macro EP' flashed HUGE green. The breakout environment is coming back.

Just as we love earnings EP, I consider $IWM $MDY $XBI Macro EPs. Anything but follow-through from here is an expectation breaker for me.

Oliver generally does two types of trades 1 - Buying stocks coming out of multi month bases 2 - Pullback buys after the initial move 👇See below for an example of each type👇

Market update. Yesterday was pretty historic in terms of the rotation and breadth rip we had. I know every macro bear out there has been hating on the Nasdaq for awhile and calling it a bubble but the reality is we had a BIG positive surge in breadth...

This too confirmed breadth - highest net positive reading in 15 weeks.

United States Trends

- 1. Army 356 B posts

- 2. $PHNIX 9.872 posts

- 3. Valverde 12,9 B posts

- 4. Marshall 23,1 B posts

- 5. Chris Christie 5.325 posts

- 6. Fede 16 B posts

- 7. Pachuca 26,3 B posts

- 8. George Stephanopoulos 34,7 B posts

- 9. Jackson State 2.671 posts

- 10. Kidney 7.611 posts

- 11. #SNME 16,4 B posts

- 12. $CUTO 11,4 B posts

- 13. #CelebrationBowl N/A

- 14. National Anthem 11,7 B posts

- 15. Arsenal 192 B posts

- 16. Simas N/A

- 17. Cherry Boom Christmas N/A

- 18. Karr 1.712 posts

- 19. Devin Nunes 5.884 posts

- 20. SC State 2.559 posts

Who to follow

-

Ignis

Ignis

@ignis55 -

Nil

Nil

@icepiercer2020 -

AnanthS

AnanthS

@AnanthrSocial -

Ted

Ted

@TedFCII -

Mike

Mike

@tripsrus55 -

Theo Cpg

Theo Cpg

@CampigliTheo -

Gordon Gekho

Gordon Gekho

@GGekho -

CW Hudson

CW Hudson

@cw_hudson -

Mr Loofah

Mr Loofah

@MrLooofa -

keith brotherton

keith brotherton

@BrothertonKeith -

Fermin

Fermin

@FerminlopFermin -

Broukersito

Broukersito

@broukersito -

FUGITIVE

FUGITIVE

@fugitive2019 -

Pocanempabé ➕

Pocanempabé ➕

@pocanempabe -

Michael Martin

Michael Martin

@michaelmartinml

Something went wrong.

Something went wrong.