Fiscal Wisdom

@MikeChadwickCFPPresident of Chadwick Financial Advisors "Securities offered through Portsmouth Financial. Member FINRA/SIPC" IAR Rep Chadwick Financial & Smartlife

Similar User

@TRontgen61592

@samanthawarrak

@ShobartMS

@TurboCFP

@devapanambur

@integritywmg

@Bigdog1153

It's almost over, but there is some room to run left!

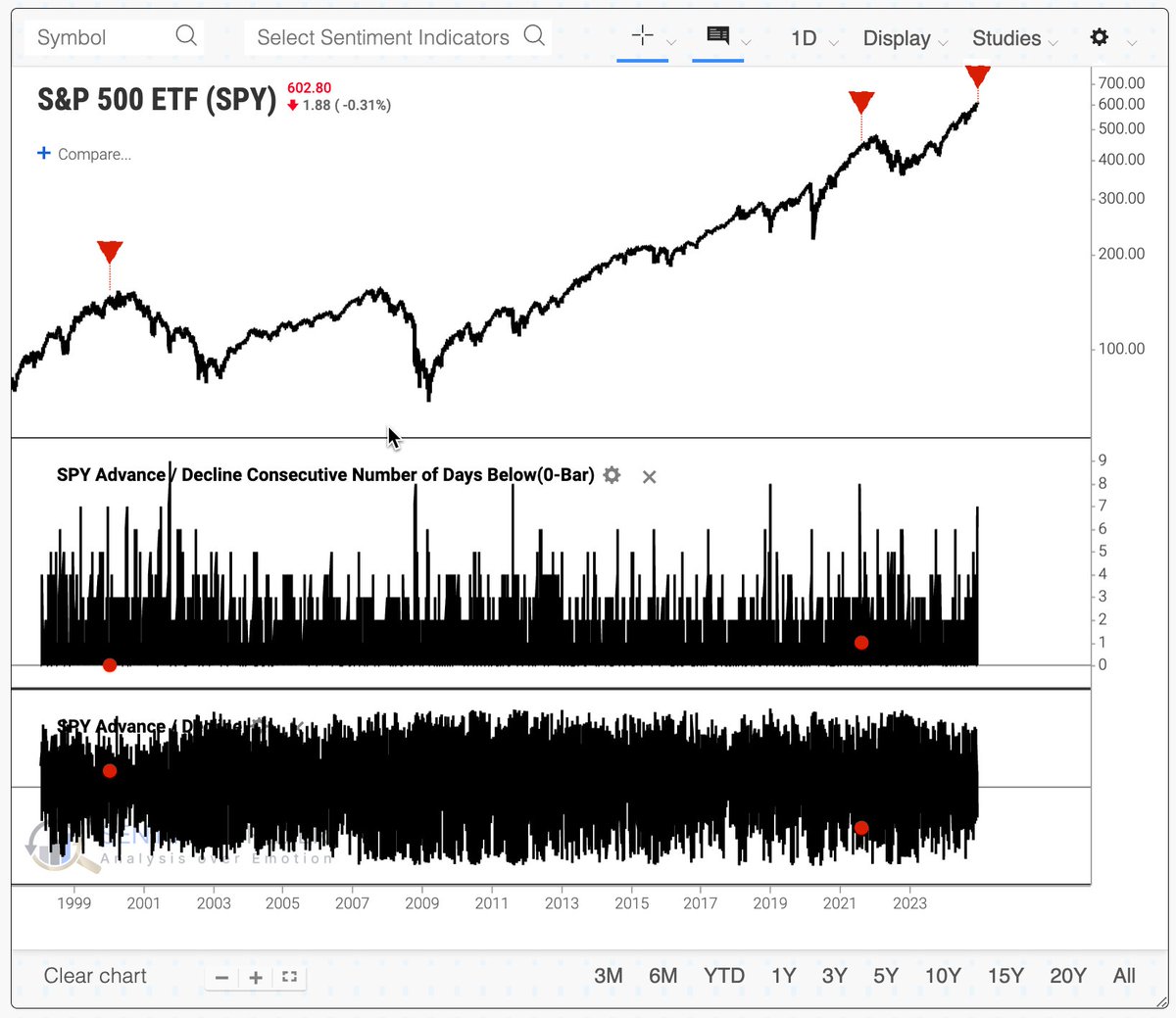

There have been more declining than advancing stocks in the S&P 500 $SPY for 7 straight days. The index is less than 3% off its peak. That's happened twice before in the past 25 years.

Healthy Tips 1. Do this exercise to look younger and perform better on the bedroom 🍆💯

$SPX Super cycle degree monthly wave count. $SPY $QQQ

#silver This chart is what contrarian investing is all about. Looks ready. Lifetime opportunity, if grabbed. #gotsilver #gotgold

‼️US UNEMPLOYMENT RATE IS SET TO RISE FURTHER‼️ The number of unemployed Americans for 27 Weeks & over hit 1.66 MILLION in November. In the past, this was a leading indicator for the unemployment rate. It now suggests the jobless rate will continue rising in the coming months.

⚠️US JOB MARKET SUGGESTS THE ECONOMY IS IN A RECESSION⚠️ The ratio between Americans transitioning from unemployment to employment to the hiring rate fell to the lowest since 2020. Such a rapid drop has never occurred outside of recessions. Hiring has rarely been so weak.

🚨WORLD'S 3RD LARGEST ECONOMY IS FALLING🚨 Germany's industrial production fell to the lowest level since 2020 in November. Industrial production has been down-trending for 7 years now. Energy-intensive industrial production dropped even below 2020 and is down 20% since 2022.

The Triple Undervaluation: Gold, Silver, and Mining Stocks Key Points: 🥇 Gold is undervalued relative to fiat. 🥈 Silver is even more undervalued than gold. ⛏️ Mining stocks are the most undervalued of all, amplifying the opportunity. Gold has been money for 5,000 years, but…

⚠️THIS IS TRULY HISTORIC: The S&P 500 Price-to-Book (P/B) ratio rose to 5.3x, the highest level since the 2000 Dot-Com Bubble Burst. As a reminder, book value is company's total assets minus its total liabilities. P/B ratio has DOUBLED since 2020. Market is wildly expensive.

Value here folks for a while anyway.

I’m calling it again. Earlier this year in January I called that $BABA would bottom when it was $65. Shortly after it ran to $117+ Now $BABA is back down to $85 and I’m calling it again. This time, I predict $BABA stock price will reach $210+ by March 2025. Mark my words…

America isn't overpriced at all, it's the indexing craze and the momentum thinking of most investors that is driving this. It ends soon folks, don't be on the wrong side of this train wreck.

It’s almost ironic that some interpret the recent shift in political leadership as a fresh chapter of American exceptionalism, when in reality, we have already experienced an extraordinarily extreme period. While this trend could persist for some time, it is difficult to argue…

Blow off top on low volume. Market melt up on low volume. Whatever you call it, it's not going to last.

This is the lowest two week SPY volume in 20 years. The event is called "sell". And then the Artificial Intelligence machines will meltdown.

Sadly, the comparison is accurate, risk is grossly mispriced and less than 10 stocks leading isn't a healthy advance, not even close!

‼️US STOCK MARKET HAS NEVER BEEN SO CONCENTRATED‼️ The biggest US stock market cap is ~750 TIMES larger than the 75th percentile stock, the most EVER. This metric exceeded all other past market bubbles. For example, in the 2000 Dot-Com Bubble, the ratio did not surpass 600x.

🚨CRASH ALERT🚨 DOW JONES 1929 VS 2024 * recored breaking overvalued market in history * % gained exact over similar time frame. *Deranged gamblers, similar , worse today. Wont be long.

It's looking eerily like 1929, will the outcome be similar? Risk is so mispriced today the masses cannot see it. Watch out below!

🚨CRASH ALERT🚨 DOW JONES 1929 VS 2024 * recored breaking overvalued market in history * % gained exact over similar time frame. *Deranged gamblers, similar , worse today. Wont be long.

The weight of the super 7 has NEVER been so lopsided. If the nifty fifty in the 70's was an unhealthy dose of leadership, how does super seven look today? Expect flat markets for a couple of decades at least!

The recent $SPX rally to ATHs has been overwhelmingly driven by just a handful of stocks, while the broader index has quietly sold off all week. As a consequence, the correlation between $SPX and its equally weighted counterpart is quickly heading back toward historic lows.

Risk is grossly mispriced.

S&P 500 price to book basically at 2000 levels.

Not the best company in the world historically.

Only 7 other times in history has S&P500 $SPX recorded over 50 ATHs in a calendar year. In 5 of the previous occurrences, S&P 500 delivered a negative return in the following year. Median return of all occurrences = -6% Being AWARE, how things are happening today and with…

This screams stupidity, how ironic it's happening in our schools. Pathetic...

The problem with government today, we see it in education, healthcare, anywhere government exists it expands. It's not expanding because of a larger customer base, it just gets more and more lethargic, sucking the life out of the system it's meant to serve.

United States Trends

- 1. #instagramdown 14,3 B posts

- 2. Iran 213 B posts

- 3. #idegen N/A

- 4. West Point 20,8 B posts

- 5. #facebookdown 9.397 posts

- 6. $CUTO 9.244 posts

- 7. Tucker 44,6 B posts

- 8. WhatsApp 225 B posts

- 9. Jeff Van Drew 10,9 B posts

- 10. Snoop 11 B posts

- 11. WNBA 45,7 B posts

- 12. #FreenXRedSeaFilm 176 B posts

- 13. #BeckyXRedSeaFilm 168 B posts

- 14. Paredes 11,1 B posts

- 15. New Jersey 85 B posts

- 16. Taina 8.220 posts

- 17. Josh Williams 1.905 posts

- 18. Facebook and Instagram 9.031 posts

- 19. GLP-1 2.038 posts

- 20. Bill Belichick 15,5 B posts

Something went wrong.

Something went wrong.