Mahesh

@MaheshJagadishLife long learner in pursuit of freedom / investor in public and private markets. Go Heels!

Similar User

@analogcap

@RedwoodCap

@AyyouEm

@True_Scuttle

@Kevin_Holloway

@Scuttlebutt_Inv

@PetramcoC

@NegativeRebate

@komrade_kapital

@NMPCap

@FundsmithLLP

@yesandnotyes

@rtclark

@MicawberCapital

@judsoninvest

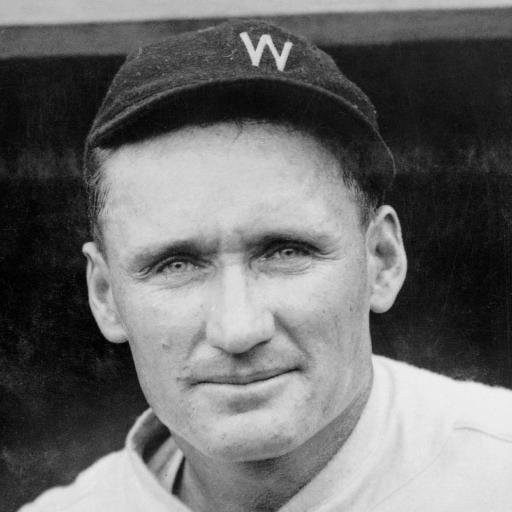

🧵 Our 7 favourite insights from the speech Chuck Akre gave a speech at the 8th annual value investing conference titled 'The Search for Oustanding Investments' in 2011. "Compounding our capital is what we’re after, that’s what makes it a great investment for us".

Another great presentation by David Einhorn at the Value Investing Congress Must Read

Josh Tarasoff on what makes him different from other "traditional" value investors. This stuff is pure gold.

Stan Druckenmiller on position sizing lessons he learned from George Soros

Jim Simons' (one of the most successful traders ever) opinion on fundamental trading. "it just didn't seem to be a way to live your life."

Fantastic interview with Will Danoff (Fidelity PM on the $300B Contrafund since 1990) Will is a great investor and storyteller - here are 8 quotes/lessons I took away from this podcast. 1. "My grandfather was in the sweater business, and they used to say the price is forgotten,…

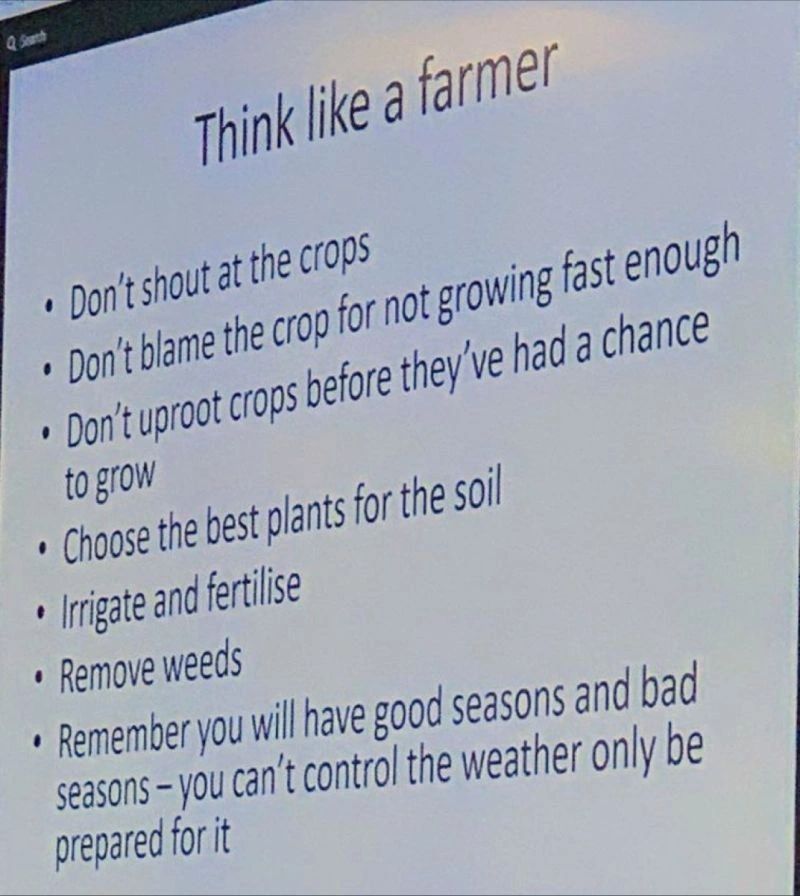

Why great leaders think like a farmer:

What's the best VIC write-up of all time?

In 25 years of Rafael Nadal x Babolat collab, the French company says he’s carried 125 different bags (always on his right shoulder), never broke 1,250 of his Pure Aero Rafa rackets, applied over 54k feet of VS Original overgrip himself and used 186 miles of RPM Blast strings.

Bryan Lawrence at Oakcliff Capital is one of the most underrated Superinvestors, achieving 17% annualized returns since 2004. He has only raised $3M net despite having $270M AUM today. In this thread, we dive into their investment process and strategy:

Buffett on why bright investment managers, with unlimited resources and the most extensive business contacts perform poorly. (1969)

Dudes relentless! Imagine if this is who you are up against.

I really enjoyed this short podcast, entitled "From Baseline to Bottom Line," in which Ronald van Loon links Roger Federer's Dartmouth talk to investing. In particular, he focuses on Fed's point that he won 54% of his points but 80% of his matches and how that can be tied back…

One of my favorite Dikembe Mutombo moments was him continuously going back and forth with MJ

Emails between Jeff Raikes and Warren Buffett Jeff Raikes pitches Microsoft . Buffett’s reasoning for not investing is thought provoking .

Druckenmiller on why you should never invest in the present. "It doesn't matter what a company's earning, what they have earned - you have to visualise the situation 18 months from now - that's where the price will be".

Tepper returned 25% annually between 1993 and 2018. More on Tepper: hedgevision.substack.com/p/appaloosa-ma…

Heico has generated 22% CAGR over 32 years, yes 22% per year over 32 years which results in a 600x+ bagger The company started manufacturing medical laboratory products, was subject to a family LBO, and figure out the perfect niche to underprice OEMs and win customers 🧵 thread…

A must read An Honest Reflection after Two years since the Funds Inception From Peninsula Capital

United States Trends

- 1. Kash 679 B posts

- 2. #FayeYokoYentertainAwards 165 B posts

- 3. SPOTLIGHT COUPLE FAYEYOKO 166 B posts

- 4. Happy New Month 114 B posts

- 5. Houston 32,6 B posts

- 6. #sundayvibes 3.332 posts

- 7. Fauna 90,7 B posts

- 8. Iowa State 10,3 B posts

- 9. #HookEm 15,6 B posts

- 10. jeno 323 B posts

- 11. Wray 55,7 B posts

- 12. #LAGalaxy 2.114 posts

- 13. #BYUFootball 1.081 posts

- 14. Texas 181 B posts

- 15. McCabe 41,6 B posts

- 16. Big 12 30,6 B posts

- 17. Oregon 36,7 B posts

- 18. Micah Alejado N/A

- 19. Elko 3.410 posts

- 20. Hololive 42,4 B posts

Who to follow

-

Analog Capital

Analog Capital

@analogcap -

Redwood capital

Redwood capital

@RedwoodCap -

JV

JV

@AyyouEm -

Ian Person

Ian Person

@True_Scuttle -

Kevin Holloway

Kevin Holloway

@Kevin_Holloway -

Scuttlebutt Investor

Scuttlebutt Investor

@Scuttlebutt_Inv -

connect-the-dots

connect-the-dots

@PetramcoC -

Negative Rebate

Negative Rebate

@NegativeRebate -

komrade

komrade

@komrade_kapital -

No More Parties

No More Parties

@NMPCap -

Fundsmith LLP UK

Fundsmith LLP UK

@FundsmithLLP -

Doug Ott

Doug Ott

@yesandnotyes -

Thompson Clark

Thompson Clark

@rtclark -

Micawber Capital

Micawber Capital

@MicawberCapital -

Judson Investments

Judson Investments

@judsoninvest

Something went wrong.

Something went wrong.