Similar User

@NL422913

@SpireHold

@alexandrecruza8

@S_Drunkenmiller

@khellz271

@SergioLeone64

@thestockguy420

@austinneal39

@Brewskiii21

@Emylianguler

@JumpManTrades

@AlexLee50838608

Outlook & Magnificent 7 Q3 Earnings Review Summary: With Central banks cutting aggressively and governments stimulating even more, I think stock markets remain strong through the first half of 2025. My favorite Mag7 names based on fundamentals through year-end are $META and…

Last Friday, #ES_F broke out a 1 month inverse H&S at 4830, starting a leg up. We've hit 4925 1st target. Big Picture target remains 5060, resistance of bull market channel from 2022 Plan: As long as 4895-4900 holds, run to 4970, 4990, 5060. If 4895 fails, we back-test 4830 1st

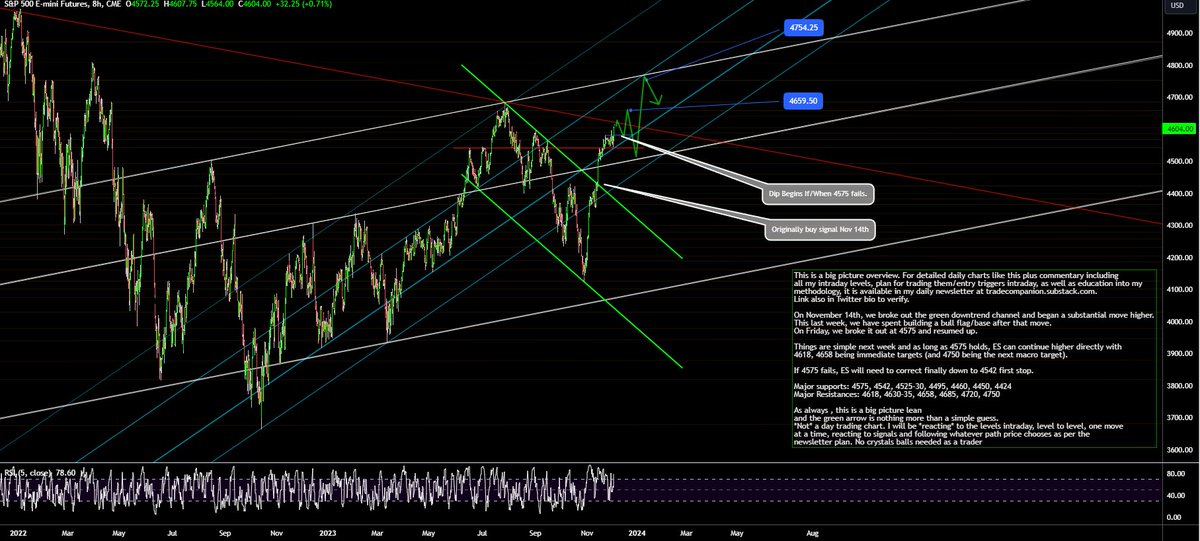

After rallying 460 points then basing for a week, #ES_F broke out ystd @ 4575. As always: Rally continues until a support fails Dec/Jan View: As long as 4575 holds, ES continues to 4618, dip, 4658. This is last res before 4755 which is now target. 4575 fails, we sell to 4542 1st

Could the upper middle class be fucked?

Following the CPI print the market went from a 14% chance of a December hike to 0%...which means the hiking cycle is done (but we kinda already knew that) But when the fed starts cutting, it's rarely been good news for the market

« Stock market is rallying that means recession is canceled » No dude. Stop hitting me with this dumb line. Equities are still stuck in 2022: fearing inflation and PE compression through rates. So evidently, any detente on that front is being played aggressively. Not to…

As posted, $SPX seasonals have tracked precisely all year (most recently with bearish back half of Sept and Oct seasonal low). Oct/Nov are strong on avg While we are still above Oct lows, its finally starting to deviate from its avg. IF its to keep tracking Oct must end strong

$SPX Seasonality continues to track with high precision: July most bullish month of the year; check. Early August 1st peak then consolidation month; check. 1st half of Sept rally; check. Back half of Sept melt-down; ongoing. IF continues, the major seasonal low is early October

Markets in a very dangerous spot here. Statistical risks flashing red. Banks and Utilities too. Credit starting to move. Lev loans liquidity sucked out. CRE unwind accelerating and housing market about to freeze. 🚩🚩🚩🚩🚩🚩

So here’s my issue. Everything happening lately is sort of outside the Fed’s control. This isn’t deflation where you debate print vs fiscal. It’s QT vs fiscal restraint. It’s not Alice in Wonderland’s 6 impossible things before breakfast - it’s Stranger Things’ Upside Down. 1/17

Even when "everyone" is expecting a recession, most are still caught off-guard when it actually happens. The reason? Our poor appreciation for and understanding of nonlinearity. "How did you go bankrupt?" "Two ways, gradually, then suddenly." This classic Ernest…

I’m not sure I have it in me to keep pumping out these framework threads anymore, but I will drop another historical comparison here for you friends to keep an eye on. 🧵 1/18

Oil price impact on inflation is secondary to it’s impact on growth this time around. This combination of Oil + $ is a wrecking ball. For EM obviously, but also for the US Consumer who managed to overcome one of the highest stress period since the early 80s (measured by…

Let me just make one thing clear. The bond doomists, waging all sorts of fear mongering from term premium to supply to bear steepening, are clearly not traders. Let me explain. When you enter a trade, you always have a plan. A stop-loss, an expected R/R and a profit target if…

Kind reminder that Fatwa on $ shorts has been and remains fully enforced… Allah Akbar!

Have a great weekend! Since June, only 1 level has mattered in #ES_F: 4492. Very simply, bulls control above, bears below. It just reclaimed Plan Next Week: 4515, 4492-87=supports. As long as 4492 lowest holds on dips, rally continues to 4542, 4580+. 4492 fails, we sell to 4410

A drop in the equity market becomes a higher probability when: - The market is excessively long and runs out of buyers (this already happened) - When breadth becomes too narrow (breadth looks ok here) - When the market becomes extended and is due for some mean reversion (this,…

I have been bullish all year from 3912 to 4636. I am bearish the 4th quarter. I can see ya trading to 4187 to start, possible to 3912. That said-if we hold 4453 I will be long. If we are above the OR I will be long intraday. This is the greatest job ever created.

$NVDA BEATS LIKE A SCREAMING ORGASM! 🤤 💦 +101% growth, Data Center +171% y/y, +141% q/q. 😃 Record gross margin at 70.1%, +5.5pts on last q. $6.4bn in OpCF, up from $2.9bn last q. Q3 guide $16bn rev vs $12.5bn consensus! JUST INSANE! 🚀 Jensen is EMPEROR OF ALL TECH! 👑

There’s no sugar coating this, CCP is in a very hard place, as much for it’s own policy choices as owing to current Fed and ECB uber hawkish monetary policies. Situation is more dire than laymen realize. Yuan is already one of Asia’s weakest $ pairs, down 6% YTD. Lowering 1y LPR…

After the Adyen earnings, Stripe investors are now down 50% on the latest $6.5bn round from March, which all went to cash out employees. But at least they don’t have to mark to market, so they can delude themselves thinking they’re fine. And so the wheel of time turns...

$WMT Solid beat & raise. SSS +6.4%. US ecom sales +24% (vs +11% $AMZN and $TGT -11%). Acceleration & share taker! FCF $9bn 👍. Nice EBIT margin expansion. Even groceries outgrowing inflation. Now at 25x current year P/E; 12x EBITDA. Not exactly “cheap”, but very solid execution.

United States Trends

- 1. Black Friday 517 B posts

- 2. #TheOfficialTSTheErasTourBook 9.709 posts

- 3. #TTPDTheAnthology 10,1 B posts

- 4. $CUTO 8.707 posts

- 5. #socideveloper_com N/A

- 6. #FridayVibes 5.455 posts

- 7. #TaylorSwift 1.403 posts

- 8. Great War 8.749 posts

- 9. Good Friday 60,7 B posts

- 10. Cutoshi Farming N/A

- 11. FROMIS TOO 1.833 posts

- 12. Aleppo 117 B posts

- 13. Datsun 13,2 B posts

- 14. Kyrie 34,1 B posts

- 15. Cyber Monday 12,9 B posts

- 16. Secured 36,6 B posts

- 17. Merry Christmas 24,7 B posts

- 18. Algebra 11,6 B posts

- 19. YOKO AT BVLGARI 288 B posts

- 20. TODAY ONLY 83,5 B posts

Who to follow

-

Rocks

Rocks

@NL422913 -

SpireHold

SpireHold

@SpireHold -

Short Gamma Unch on the Day

Short Gamma Unch on the Day

@alexandrecruza8 -

Stanley Drunkenmiller

Stanley Drunkenmiller

@S_Drunkenmiller -

bucky

bucky

@khellz271 -

Sergio Leone

Sergio Leone

@SergioLeone64 -

The Stock Guy

The Stock Guy

@thestockguy420 -

Austin Neal

Austin Neal

@austinneal39 -

Brewski

Brewski

@Brewskiii21 -

Emilyanguler

Emilyanguler

@Emylianguler -

JumpManTrades

JumpManTrades

@JumpManTrades -

Alex Lee

Alex Lee

@AlexLee50838608

Something went wrong.

Something went wrong.