Similar User

@LegendSergen

@JohnN_Mex

@StocksFormula

@RoyalTradingA

@sk0rpius

@kwangahlomla2

@VuyiswaNdlovu16

🤷♂️ we gonna freak out every time there's a pullback

7/ Example Strategy: For the 11/20 expiration (highest GEX): Watch 5850 Put Support: A bounce here could indicate a buying opportunity. Monitor 6000 Call Resistance: Breaching this level may trigger bullish acceleration. Expiration (-12.00% GEX): Expect volatility…

It’s common to see OPEX blamed as the go-to scapegoat for market moves, but today provides a strong example of those flows genuinely impacting the market. Stocks have faced consistent selling pressure throughout the day, and equity market volatility has finally come alive. The…

🥐 fresh crumbs with OJ 🧃 #OPex week Dips are #BUYING opportunities 👸🦥 + positive Jan 1st flows will continue to grind $SPX higher through the low volume holidays #Dispersion is back and we may see a running of the MEMES🎲 We can expect to see a shift in market leadership,…

Whatever price is trading on January 21 2025, subtract 30% from that. So let’s say it’s 6300. Subtract 2100 from it. That will give you 2025 low of S&P500. You’re welcome.

Bullish November Has Weak Points 1st 5-6 trading days bullish then weakness into week before Thanksgiving. DJIA & S&P 500 strength has shifted to mirror NASDAQ & Russell 2000 w/ most bullish days at the beginning and end of the month.

A simpler way to 🧠 about this… internal (US supply-constrained) inflation 🆚 external (Global non-supply constrained) deflation… Anyone want to guess 🤔 what closing borders with tariffs & tighter immigration policy are going to do to these 📉 📈?

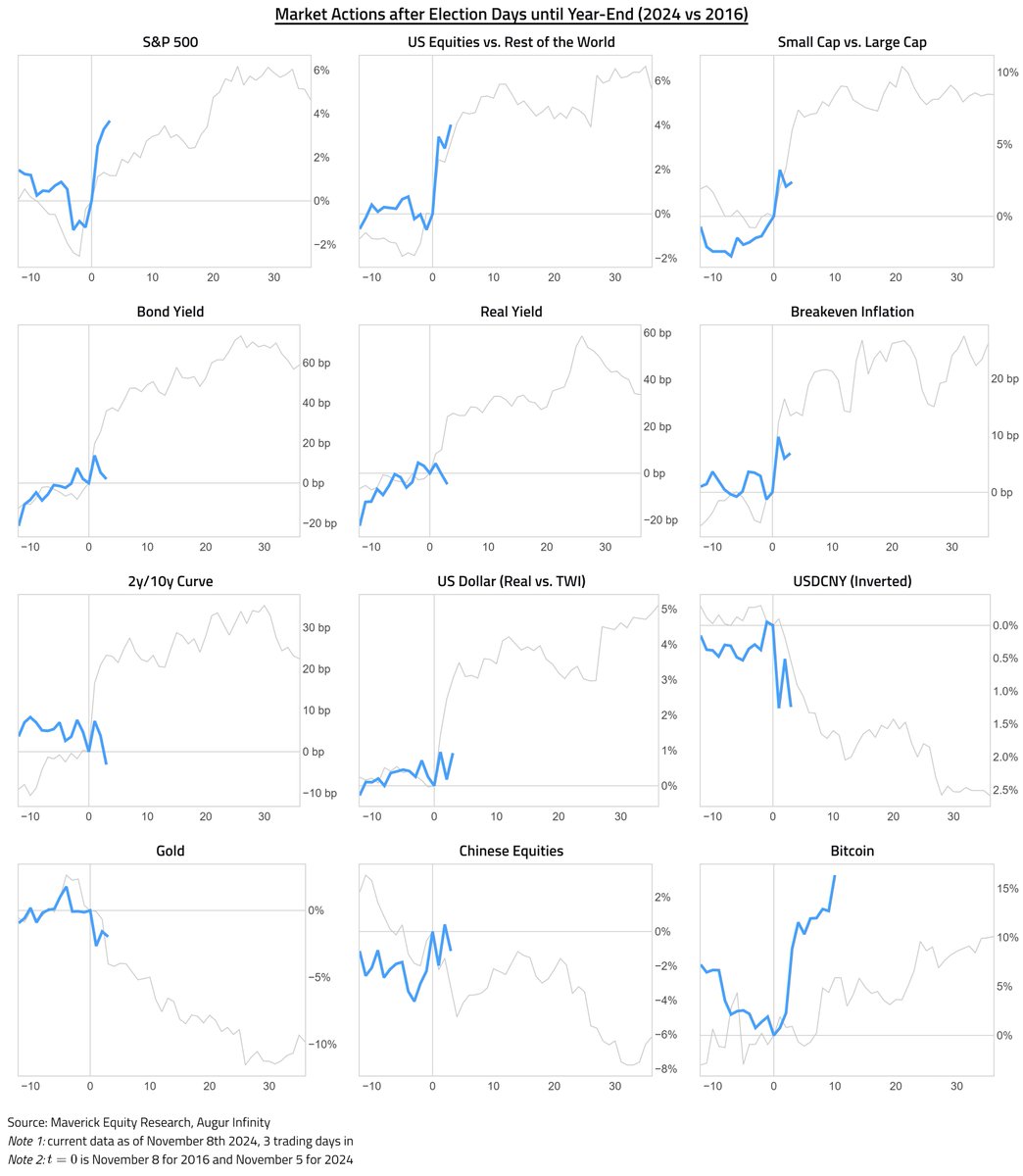

2024 vs 2016 overlay as 'The Trump Trade': 12 ideas via one Maverick visual for 10,000 words and the U.S. post elections Chart of the Year ... enjoy 👇 How similar is the 2024 markets' reaction to 2016? Visual is after 3 trading days in and until year-end: ➡️ S&P 500 = UP, way…

Hedge fund net leverage is on the rise after last week's powerful rally, but nowhere near the highs we saw in 2021, per JP Morgan.

Corporate buybacks are coming back in a big way soon, helping to power some of that November and December positive seasonality that we often see and attribute to the Santa Claus rally. 🎅

For the #opex week... (Fed, VIX, MM positioning and levels) MM weekly gamma exposure into #opex is attached below. I talked about vanna squeeze up as hedges start to be unwound ✅ (not exactly the way i expected, but it is what it is...) I marked 5923 $SPX as the lvl where MMs…

This market is expecting a 25 BPS cut today at 1 PM FOMC and no change to the language. Any thing other than that is an unknown and hence a 100 dollar sell off. Now 6000.

QQQ. Breaking out to new all-time highs. I'd like to see a pullback in the markets to retest the former all-time highs breakout at $498 - $504 to new demand. Risk for longs in overall market should now be a failure to hold this new demand. If we can turn supply into new…

This one was a lot of fun. @spotgamma and I talk volatility and tail risk with @Ksidiii youtu.be/WsAs6DAktmY ☑️ A behind the scenes look at long vol strategies ☑️ How they fit into a portfolio ☑️ What it is like managing one during a crisis ☑️ Inside the August 5th VIX…

Fun fact: This was only the 5th time since 1960 that $SPX returned more than 2.5% while simultaneously breaking into an all-time high. The last time this happened was March 21st, 2000.

Short vol and 80/20 crash alert at the same time. My God.

Difficult trade being executed by the 🤖🤖. Will let you lnow when they are done. #HARDBET

Yesterday I did a podcast with @practicalquant & @spotgamma . We went over some pretty cool stuff in the Vol space. One key area we explored was why I believe a post-election Vol crush was inevitable. This outlook was largely influenced by the repositioning we observed in the…

Upcoming deregulation wave will create an economic sonic boom.

Volume in VIX puts was more than 2x that of calls on Friday. That's one of the highest turnovers in 15 years. It has typically spiked at times of extreme anxiety.

United States Trends

- 1. #UFC309 133 B posts

- 2. Bo Nickal 7.350 posts

- 3. #MissUniverse 395 B posts

- 4. Tatum 24,9 B posts

- 5. Tennessee 52 B posts

- 6. Beck 20,5 B posts

- 7. Oregon 32,7 B posts

- 8. Paul Craig 4.073 posts

- 9. Chandler 34,2 B posts

- 10. Georgia 94,9 B posts

- 11. #GoDawgs 10,6 B posts

- 12. Dinamarca 33,7 B posts

- 13. Nigeria 265 B posts

- 14. Locke 5.700 posts

- 15. Wisconsin 46,2 B posts

- 16. Venezuela 215 B posts

- 17. Dan Lanning 1.281 posts

- 18. gracie 20,5 B posts

- 19. Mike Johnson 41,5 B posts

- 20. Oliveira 42,9 B posts

Something went wrong.

Something went wrong.