Similar User

@DanielBN_

@Jordirvv

AAA you say? History rhymes yet again…

.Investors in the AAA tranche of $308M debt backed by 1740 Broadway in midtown Manhattan received only 74% of their money. Creditors in the five lower groups were totally wiped out. #commercialrealestate #credit #NewYorkCity globest.com/2024/08/29/how…

Say what you want about $IBKR's interface Their segregated cash portfolio duration is ~42 days Petterfy on duration mismatch risk (Q4 call):

1/🧵 I joined Twitter to learn more about business and investing. To clarify my thoughts and to share what I’ve learnt, I've made a series of threads on some of the most important topics. All these threads can be found below so please share! Best enjoyed with a cup of 🫖

1/🧵 I like free cash flow (FCF) - who doesn’t. But even the best of metrics can lead us astray since free cash flow can be created “out of thin air”. In this thread we look how this can be done, and counter it with ADJUSTED FREE CASH FLOW. Best enjoyed with a cup of tea 🫖

Red Flags to watch out in financial statements. Courtesy : @safalniveshak

1/8 Munger: Long-term stock returns won't differ much from the ROIIC of biz - regardless of entry price. Still, price must matter. To build intuition for returns vs. entry price, ROIIC, and holding period... ...here follow some simple scenarios, with polls.

Unfortunately also Warren Buffett: „Price is what you pay. Value is what you get“

"Our favorite holding period is forever." - Warren Buffett

The same people who now happily pay 14x revenue for Microsoft will not be willing to pay 14x earnings for Microsoft in the future. And they will have clever-sounding reasons for both.

The best investments are not found in the stock market Realizing this makes you a better person and investor

• Do what interests you the most. • Spend time with nature. • Ask questions. • Never stop learning. • Don't pay attention to what others think of you. • Read everyday. • Study hard. • Teach others what you know. • Make mistakes and learn. • It's Okay to not know things!

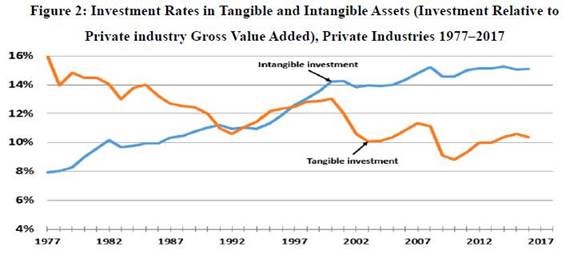

1/ Why Value & Growth is no longer just about valuation. The nature of business is not static. While core principals are often timeless, the underlying dynamics can change dramatically over time. Case in point, this is one of the most important charts in investing.

United States Trends

- 1. Turpin 9.115 posts

- 2. Cowboys 36 B posts

- 3. Panthers 35,6 B posts

- 4. Texans 24 B posts

- 5. Bryce Young 5.972 posts

- 6. Bears 61,6 B posts

- 7. Colts 28,6 B posts

- 8. Commanders 38,8 B posts

- 9. Titans 41,7 B posts

- 10. CJ Stroud 2.992 posts

- 11. Will Levis 4.060 posts

- 12. Caleb Williams 7.974 posts

- 13. Jayden Daniels 5.080 posts

- 14. Giants 62,5 B posts

- 15. #RaiseHail 7.860 posts

- 16. #OnePride 9.772 posts

- 17. Eberflus 5.034 posts

- 18. #DALvsWAS 7.511 posts

- 19. Kliff 3.351 posts

- 20. #ChiefsKingdom 4.164 posts

Who to follow

Something went wrong.

Something went wrong.