CryptoKea

@CryptoKeaPassionate about crypto. Sharing the best models, on-chain metrics, findings, knowledge & thoughts from the space. Nothing I say/show is financial advice.

Similar User

@MustStopMurad

@PositiveCrypto

@CryptoCharles__

@dpuellARK

@hcburger1

@coinmetrics

@filbfilb

@RNR_0

@unchainedcom

@River

@NakamotoInst

@caprioleio

@AureliusBTC

@dilutionproof

@ColeGarnersTake

In the last bear, one of the reasons @placeholdervc focused on @solana was a belief that it would be the normie-chain w/ its speed, low fees & smooth UX. That's playing out with memecoins & more. But we've been @ethereum supporters since inception, and that hasn't changed... 🧵

Applications on Ethereum and Solana are on the verge of flipping their underlying infrastructure in revenue. What does this mean for the future of value capture in the cryptoeconomy?

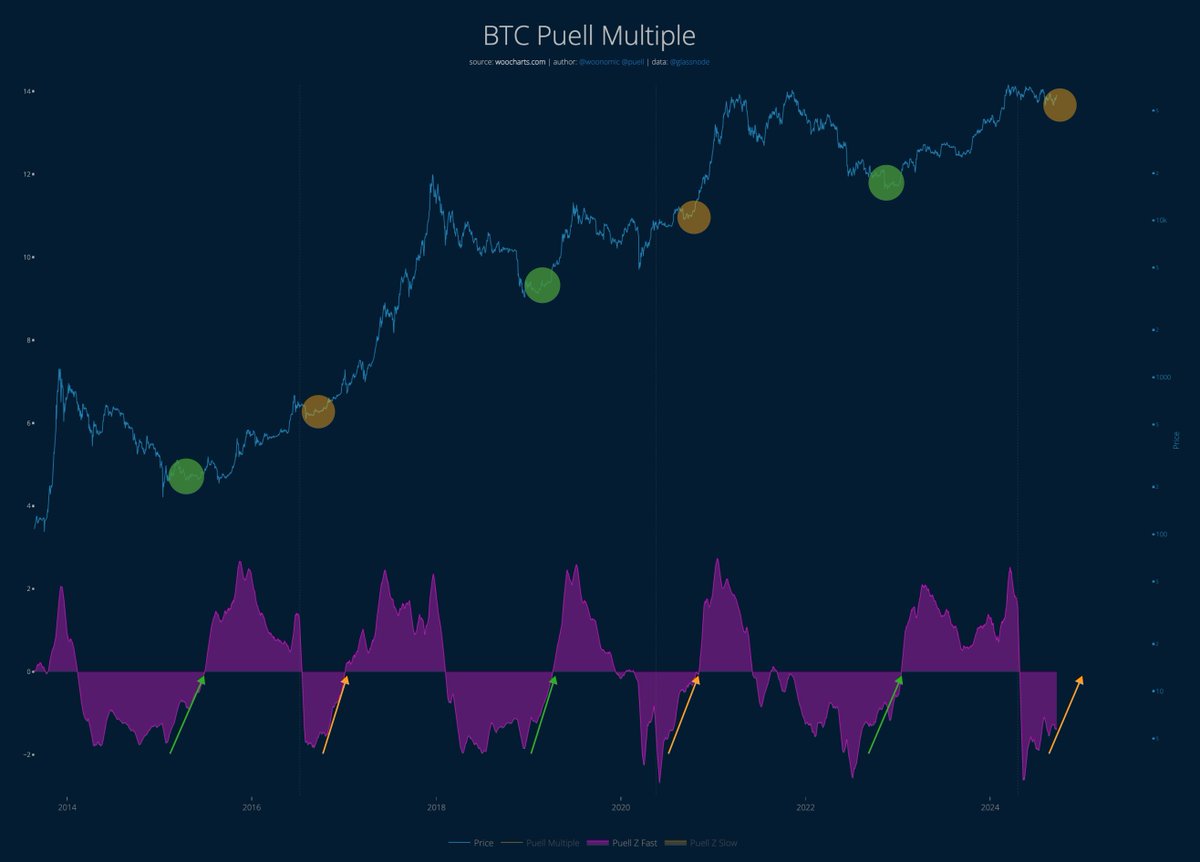

Famous quote from Dr Puell. "The best time to buy #Bitcoin is at the bottom, the second best time to buy is at the post halving re-accumulation" He didn't say it in words, he said it in numbers. I've cleaned his model up to say it a bit clearer.

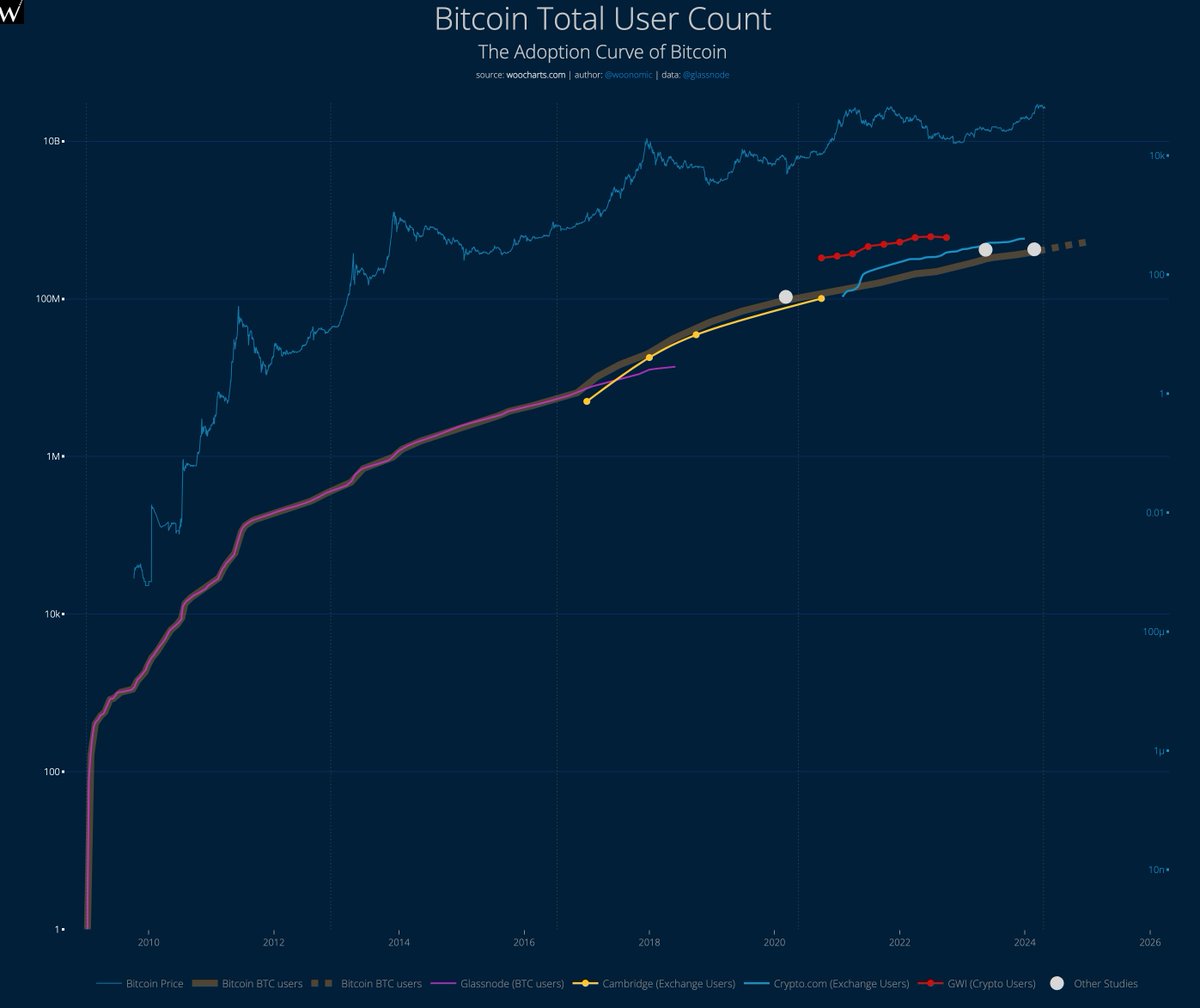

426m #Bitcoin holders today. 0.5 billion by Oct. - All past studies of user count visualised - Early data via on-chain clustering by @glassnode - Then add KYC'd exchange users from Cambridge and Crypto·com studies, adjusting for BTC-only - Then project growth rate forward

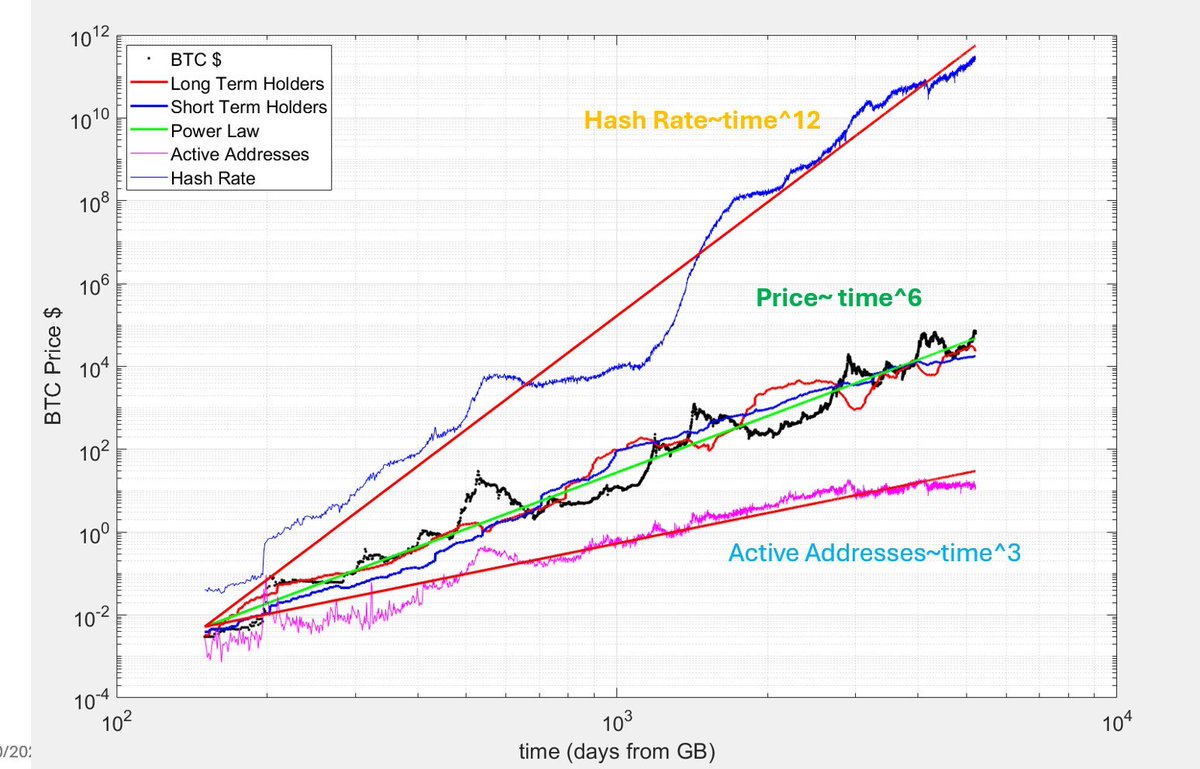

#Bitcoin this is the only graph you need to fully understand Bitcoin. All the info is here. All the behavior of Bitcoin is explained here (at least on the long and medium range).

Did you sell some of your ETH for SOL AVAX etc, in case they grow faster or even wins? Did you sell some of your BTC to hodl LTC or XMR in case they win? Answer that and you’ll know why BTC doesn’t have competition. Also why ETH hasn’t outperformed despite being deflationary.

This is a #Bitcoin long timeframe risk signal I've been working on. Scale in when risk is low, scale out when risk is high. It's saying, "enjoy the dip while this consolidation last". This is not the top, it's simply ATH consolidation.

Dencun went live, we've had blobs land in blocks on mainnet .oO 🎉

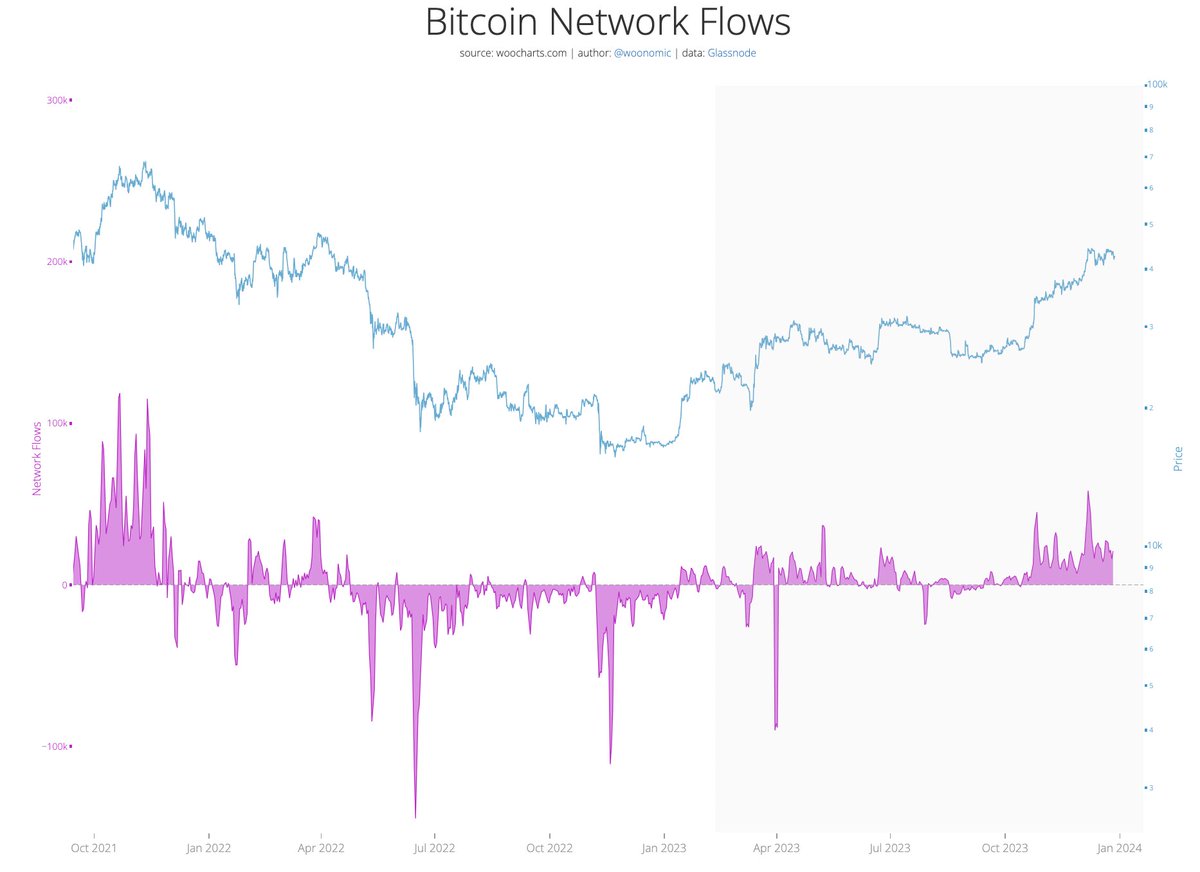

A conviction among #Bitcoin stackers during this cycle is really unprecedented. Still no signs of meaningful distribution on the board.

10 years ago, Bitcoin mining was a hobbyist activity. Today, it generates more annual revenue than some of the largest publicly traded companies in the world. Spotify, eBay, Hermes, Chipotle, Hertz, and Hilton all generate less annual revenue than bitcoin miners.

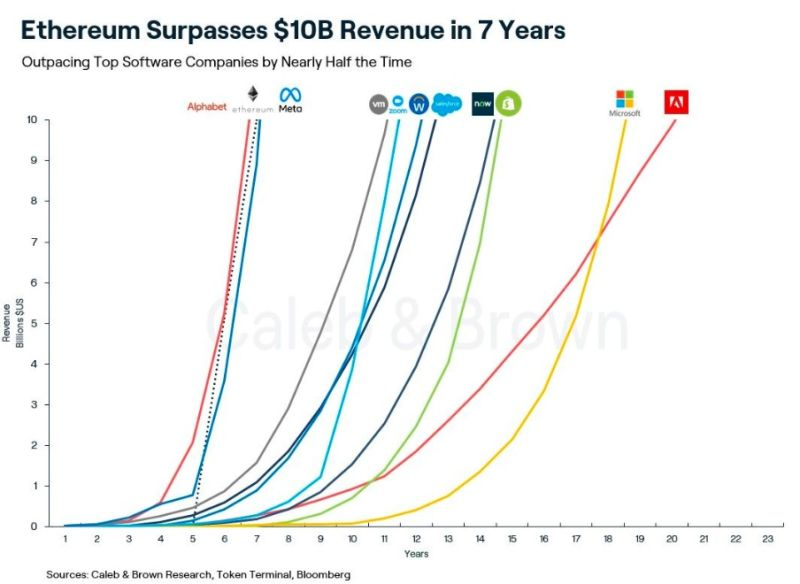

Quick reminder that Ethereum hit $10 billion in revenue faster than any other major software company besides Google. h/t @JustDeauIt

Bitcoin's hash rate hit an all time high 500 exahashes/s this month. To highlight the enormity of this number: - For every star in our galaxy, the Bitcoin network is calculating 5 billion computations per second. - It would take ~2000 years for the entire global population,…

One of my favourite on-chain indicators is the increase or decrease in realised cap, which measures the capital being stored by the #Bitcoin network. We are in a region where money is being poured into the network at an increasing rate.

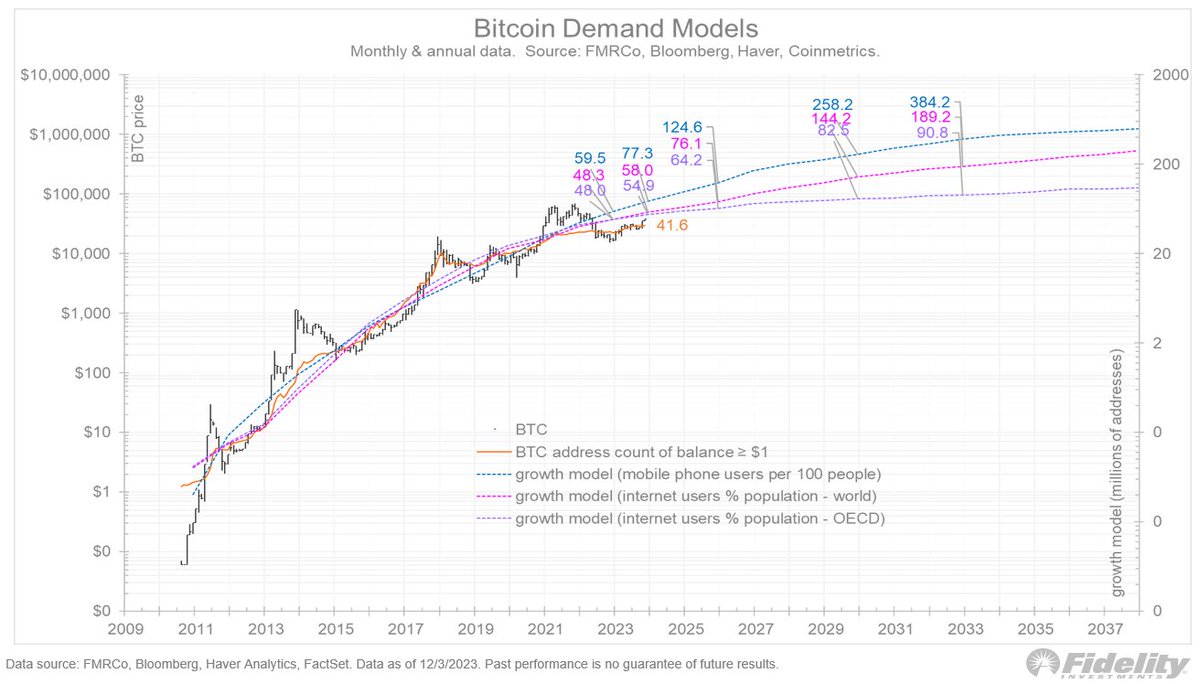

The next chart illustrates this. Adoption curves for internet users and cell phone subscribers look similar, but once they are curve-fitted against Bitcoin’s network, even the smallest change in slope from the exponential phase to the asymptotic phase matters. /9

Blown away by the new #bitcoin marketing video

In April 2024, Bitcoin's Electrical Cost, the raw energy cost of mining Bitcoin, will double overnight. This is a certainty. Inefficient miners will then start shutting down as the Bitcoin reward Halves. In the last two Halvings, Electrical Cost bottomed at +65% and +50% of the…

When you regularly see crypto ads on this sphere, it’ll be time to sell again

You can advertise on the Las Vegas Sphere for 450k a day...

AVIV is IMO the best valuation model for Bitcoin, which for those who skipped to this part, essentially compares the amount of actively traded supply to the amount of value stored in the network. Almost perfectly spending 50% of time above/below "1", this is the true mean.

Recently two of my good friends, the head analyst at Glassnode (@_Checkmatey_) and head on-chain analyst at Ark Invest (@dpuellARK), created a new methodology to evaluate Bitcoin's economics called Cointime. I've broken it down into simple digestible terms: [THREAD 1/12]

In the future, everything becomes a rollup, tapping into the security of a handful of multi-trillion-dollar base layers -- simple as that.

United States Trends

- 1. $CUTO 8.080 posts

- 2. ICBM 195 B posts

- 3. #JusticeforDogs 1.078 posts

- 4. The ICC 276 B posts

- 5. Jussie Smollett 10,6 B posts

- 6. Denver 34,3 B posts

- 7. Netanyahu 577 B posts

- 8. Illinois Supreme Court 9.976 posts

- 9. Volvo 7.296 posts

- 10. Julian Lewis 4.508 posts

- 11. Dearborn 7.243 posts

- 12. #KashOnly 43,9 B posts

- 13. Katie Couric 2.747 posts

- 14. Flat 52,4 B posts

- 15. #AtinySelcaDay 10,8 B posts

- 16. #ATSD 11,2 B posts

- 17. chenle 133 B posts

- 18. Juju Lewis 1.101 posts

- 19. #pilotstwtselfieday N/A

- 20. Unvaccinated 13,5 B posts

Who to follow

-

Murad 💹🧲

Murad 💹🧲

@MustStopMurad -

Philip Swift

Philip Swift

@PositiveCrypto -

CryptoCharles

CryptoCharles

@CryptoCharles__ -

David Puell

David Puell

@dpuellARK -

hcburger

hcburger

@hcburger1 -

CoinMetrics.io

CoinMetrics.io

@coinmetrics -

filbfilb

filbfilb

@filbfilb -

Romano

Romano

@RNR_0 -

Unchained

Unchained

@unchainedcom -

River

River

@River -

Satoshi Nakamoto Institute

Satoshi Nakamoto Institute

@NakamotoInst -

Charles Edwards

Charles Edwards

@caprioleio -

Aurelius

Aurelius

@AureliusBTC -

Dilution-proof

Dilution-proof

@dilutionproof -

Cole Garner

Cole Garner

@ColeGarnersTake

Something went wrong.

Something went wrong.