Cash-flow Investor 🇺🇸

@BoB2TraderProtecting capital; managing risk and making it grow. Not investment advice.

Similar User

@TalkMarkets

@OptionsHawk

@JessInskip_

@nmasc_

@SharePlanner

@raultimerman

@OptionAlert

@sannbet

@SPXTrades

@SteveMatthews12

@KobesyTrades

@chessNwine

@BigWaveTrading

@ntfri

@LedwabaStyles

Schwab: Through the end of November, nearly 45% of Russell 2000 members were not profitable on a trailing 12-month basis, compared to only ~5% for the S&P 500. schwab.com/learn/story/us… @LizAnnSonders @KevRGordon

CPI MoM: 0.3% vs 0.3% exp. CPI YoY: 2.7% vs 2.7% exp. CPI Core YoY: 3.3% vs 3.3% exp. November inflation just as expected. Fed will cut another 25 bps next week.

US Nov Consumer Prices +0.3%; Consensus +0.3% US Nov CPI Ex-Food & Energy +0.3%; Consensus +0.3% US Nov Consumer Prices Increase 2.7% From Year Earlier; Core CPI Up 3.3% Over Year

CPI on a year/year basis is moving sideways, but that is as expected. It looks like the Fed will go ahead with a 25 bp rate cut at next week's meeting, which is priced into the market.

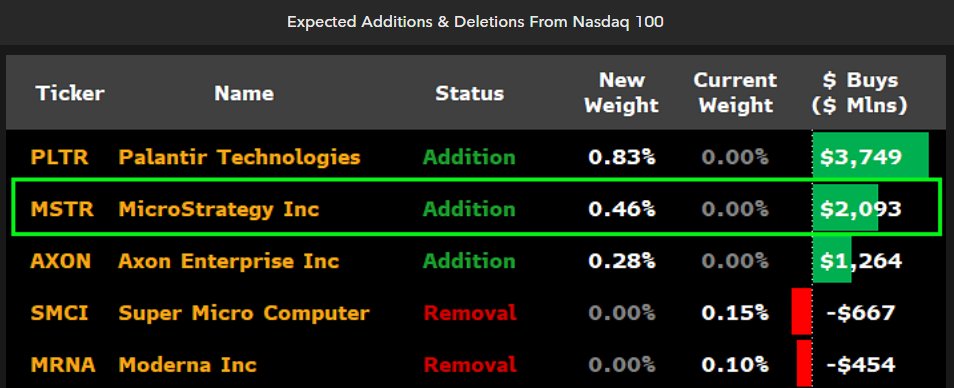

JUST IN: MicroStrategy, $MSTR, is likely to be added to $QQQ on December 23rd, with announcement coming 12/13, and Moderna, $MRN, likely to be kicked out, per Eric Balchunas of Bloomberg.

$MSTR is likely to be added to $QQQ on 12/23 (w/ announcement coming 12/13). Moderna likely to get boot (symbolic). Below is best guess of adds/drops via @JSeyff Likely a 0.47% weight (40th biggest holding). There's $550b of ETFs tracking the index. S&P 500 add next yr prob.

JUST IN: 🇺🇸 President-elect Trump says anyone investing over $1 billion in the US will receive expedited approvals and permits.

Economists who produce detailed inflation forecasts expect the November CPI to show that core prices rose about the same as in October, up 0.27% to hold the 12-month rate at 3.3% The median forecast has headline CPI rising to 2.7% from 2.6%.

BofA: US government bonds are still in double-digit drawdowns $TLT

CHINA READY TO GO DEEPER INTO DEBT TO COUNTER TRUMP'S TARIFFS In one of their most dovish statements in more than a decade, Chinese leaders signalled on Monday they are ready to deploy whatever stimulus is needed to counter the impact of expected U.S. trade tariffs on next…

At $53 billion in AUM and a 0.25% fee, the iShares Bitcoin ETF $IBIT generates roughly $132.5 million annually for BlackRock.

NY FED: NOVEMBER THREE-YEAR AHEAD EXPECTED INFLATION AT 2.6% VS 2.5% IN OCTOBER

- Largest China Stimulus since 2008. - $16T of U.S. fiscal and monetary support since 2020, including $2T deficit spending this year. - the Wealth Effect, Bitcoin and Equities. - 100bps of rate cuts in 2024. - Tariffs. - Tax Cuts. - Deregulation. = Buckle Up, Inflation.

87% chance of a cut next Wednesday

China Eases Monetary Policy In First Major Shift Since 2011 - BBG bloomberg.com/news/articles/…

New job postings on Indeed back to late 2020 levels

The market is already pricing in another 25 bps rate cut on December 18, bringing the Fed Funds Rate down to 4.25-4.50%. But the next few inflation reports are expected to trend higher and the Fed will likely be forced to pause in January. Video: youtube.com/watch?v=eVsvXE…

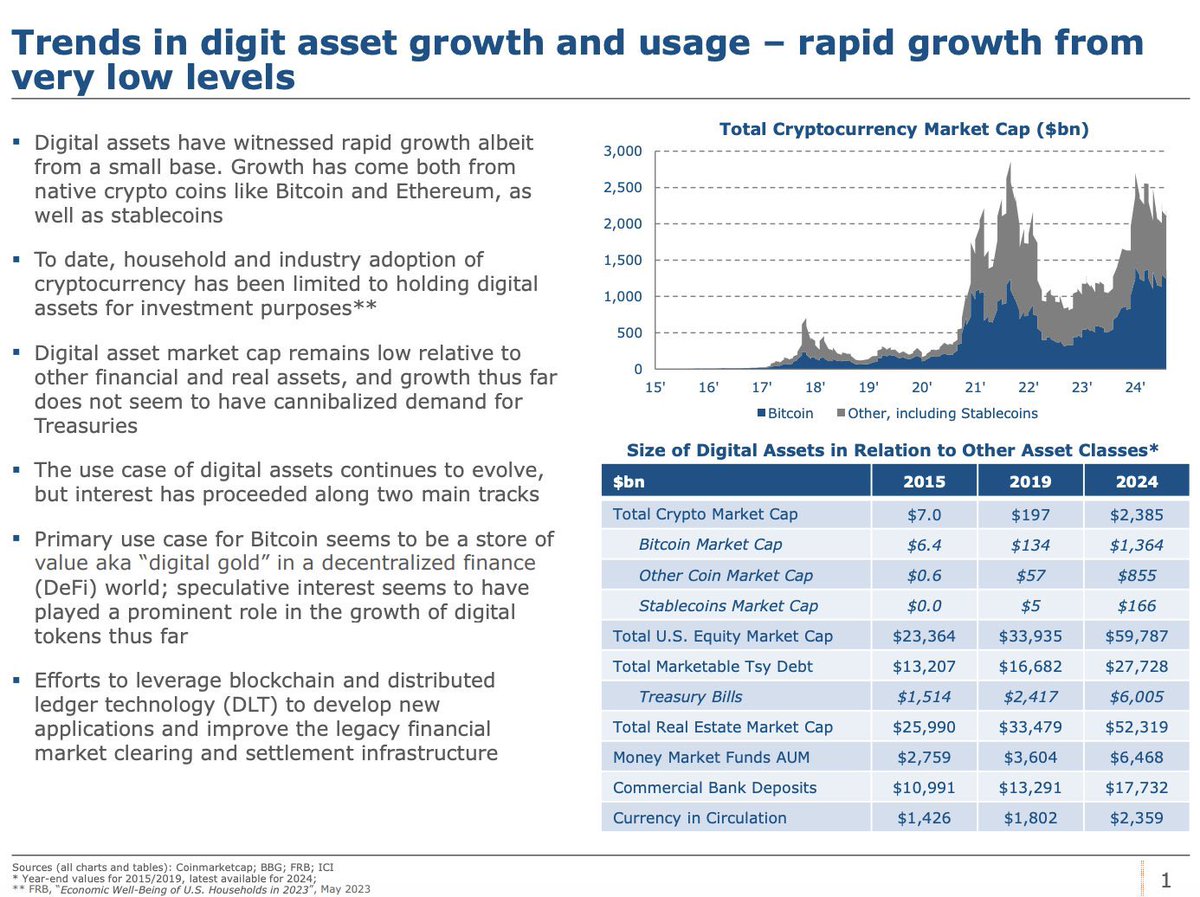

TBAC Big Section in report on Stablecoins, Bitcoin and Tokenization. The upshot while still in the early stages even the Treasury recognizes that Digital Assets implicitly create demand for UST. home.treasury.gov/system/files/2…

JUST IN: 🇺🇸 US Treasury compares #Bitcoin to digital gold. The "primary use case for Bitcoin seems to be a store of value aka digital gold."

United States Trends

- 1. $AUTOS 8.082 posts

- 2. $STAGE 5.397 posts

- 3. Good Wednesday 27,3 B posts

- 4. #WednesdayMotivation 5.581 posts

- 5. Taina 4.451 posts

- 6. Hump Day 12,9 B posts

- 7. WNBA 37,7 B posts

- 8. #TheHeartKillersEP4 87,9 B posts

- 9. #WednesdayWisdom N/A

- 10. #Wednesdayvibe 1.752 posts

- 11. Happy Hump 7.936 posts

- 12. Core CPI 2.416 posts

- 13. McConnell 67,5 B posts

- 14. #wednesdayfeelings 1.792 posts

- 15. Pivetta N/A

- 16. $SNAPPY N/A

- 17. Malls 3.492 posts

- 18. USPS 18,5 B posts

- 19. Trudeau 162 B posts

- 20. Herb 7.631 posts

Who to follow

-

TalkMarkets

TalkMarkets

@TalkMarkets -

Joe Kunkle

Joe Kunkle

@OptionsHawk -

Jessica Inskip

Jessica Inskip

@JessInskip_ -

natasha mascarenhas

natasha mascarenhas

@nmasc_ -

Ryan Mallory

Ryan Mallory

@SharePlanner -

Raúl Timerman

Raúl Timerman

@raultimerman -

Trade Alert

Trade Alert

@OptionAlert -

Sann

Sann

@sannbet -

SPX Trader

SPX Trader

@SPXTrades -

Steve Matthews

Steve Matthews

@SteveMatthews12 -

𝕂𝕆𝔹𝔼𝕊𝕐

𝕂𝕆𝔹𝔼𝕊𝕐

@KobesyTrades -

Chess

Chess

@chessNwine -

Joshua Hayes

Joshua Hayes

@BigWaveTrading -

Ⓜⓐⓡⓖⓘⓝ ⓒⓐⓛⓛ

Ⓜⓐⓡⓖⓘⓝ ⓒⓐⓛⓛ

@ntfri -

Styles Lucas Ledwaba

Styles Lucas Ledwaba

@LedwabaStyles

Something went wrong.

Something went wrong.