Afonso Português

@AfonsoPortuguesSell Side Trader | Views are my own | No investment advice

Similar User

@AlphaFinance7

@DarkKnightNoma

@sun000028886

@CoachJasonEmery

@winitsiripak

@sage_of_rain

@RozwodMarcin

Companies that are planning to fire a large amount of people in the US have to file WARN notices. Bloomberg shows how the trend in WARN notices has picked up recently (blue), pointing to a further increase in jobless claims (white).

Housing has not bottomed. Today, the MBA Purchase indicator collapsed again. #Hope

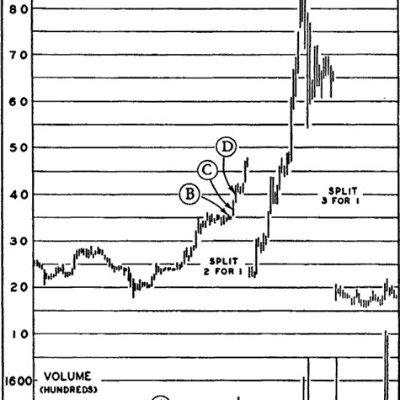

This is the scariest chart of them all in my opinion:

🇺🇸 With NFIB price components dropping, my US model indicates CPI at 2.5 %-ish y/y mid-2023.

The #economy is a social order, not an engineered machine that produces specific outputs. Before we realize this, attempts to steer, direct, and control it will be costly, destructive, and have severe unintended consequences.

🇸🇪 A quite dreadful NIER survey. Let's sum it up with my broad leading GDP indicator - 2023 should get very ugly.

🇺🇸 Recession The Economic Output Composite Index and the LEI are screaming that a US recession is around the corner 👉 isabelnet.com/?s=recession h/t @LanceRoberts #markets #economy #recession #recessions #LEI #growth #USeconomy #economics #investing

ECB day! The most important decision today is not by how much they hike or signal they'll hike going forward But rather how the ECB plans to tackle the Eurozone collateral scarcity issue German bonds (AAA collateral) command a high premium to other money market instruments 👇

🇺🇸 Earnings Should investors expect a significant decline in earnings growth? 👉 isabelnet.com/?s=earnings h/t @MorganStanley #markets #investing #earnings #EPS #sp500 $spx #spx $spy #stocks #stockmarket #equities

Great example why nobody should find comfort in “strong/solid/firm/ok coincident or lagging indicators today. Moreover, every series that lead PMIs is pointing 👇for 12m. We call those anticipatory series. Know which macro data lead and which are irrelevant. #macro #HOPE

Core capital goods new orders vs ISM new orders. ISM leads by 1 quarter, pointing to core capital goods going negative. As capital goods are used as a proxy for business spending plans, this would indicate that business spending will weaken.

US Treasury Yields since 1999...

It does not feel like a soft landing 👇 Chart @MacroTechnicals

Recession probability in next 12 months has shot up to 51.8%, as per 2s10s spread and @Economics calculation

🇩🇪 #GERMANY SEPT. GFK CONSUMER CONFIDENCE INDEX -36.5 (record low); EST. -32.0 - BBG

New low in MTD regional PMI new orders. This is the start of the next big issue for markets. No recovery in sight from long reliable leading indicators. #macro #PMIs #hOpe

√ #US new home sales plunges to their lowest level since Jan 2016👇 √ The resulting sharp increase in new home inventories – which has historically lead home prices by 1.5 year – points to a fall of home prices between 5%-10% y/y by end of next year👇

Housing market trends lead economic and labor market cycles by 6-12 months. Right now, the US housing market is signalling unemployment rate will likely be above 6% in 2023: another data point which is inconsistent with a soft landing.

The supply of new homes in the US crossed above 10 months in July, its highest level since January 2009. Every time it's been over 10 months in the past the US has been in a recession. Charting via @ycharts

United States Trends

- 1. $AROK 4.927 posts

- 2. Ohio State 21,7 B posts

- 3. Wayne 118 B posts

- 4. Indiana 31,2 B posts

- 5. #daddychill 2.479 posts

- 6. Ryan Day 3.397 posts

- 7. Hoosiers 6.692 posts

- 8. Gus Johnson N/A

- 9. $MOOCAT 6.778 posts

- 10. DJ Lagway 1.453 posts

- 11. Howard 20,8 B posts

- 12. Buckeyes 5.705 posts

- 13. #iufb 3.496 posts

- 14. Carnell Tate N/A

- 15. Chip Kelly N/A

- 16. Neil 32,6 B posts

- 17. Maddison 9.867 posts

- 18. Surgeon General 102 B posts

- 19. UMass 2.258 posts

- 20. $MXNBC 1.164 posts

Something went wrong.

Something went wrong.